- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

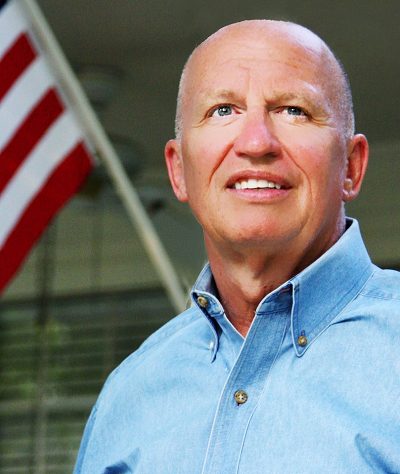

The Simplified Tax Plan in simple terms by Congressman Kevin Brady

THE WOODLANDS, Texas - Imagine your income tax filing so simple you can do it on a postcard. The bloviated tax code would be trimmed down to fit on one side of a card with just fourteen blanks to fill out.

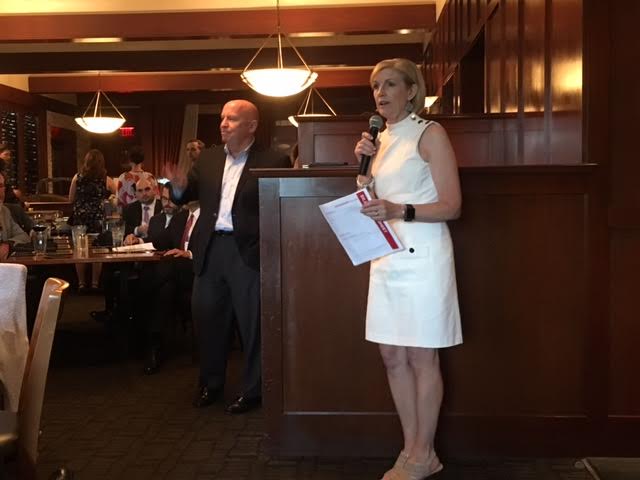

That’s what the House Ways and Means Committee is proposing, and they intend to have the bill written by the end of this year. Championing the cause is the committee Chairman, Congressman Kevin Brady (R-TX), who presented the concept to the Woodlands Area Chamber of Commerce at their quarterly 4 O'clock speaker series hosted by Memorial Hermann The Woodlands at Kirby's Steakhouse.

In addressing those present, Brady said one of two goals in reforming the tax code was growth. A tax code built to grow business; built to grow the economy.

“Growth is good, except for the tax code,” said Congressman Brady.

The second goal was to leapfrog other countries back into first place in the global economy. To accomplish this involves three main reforms:

- Growth for job creation and local business

- Fairness and simplity for Individuals and families

- Bust up the IRS

Brady explains in detail in this video...Goals & reforms of the Simplified Tax Plan

“When you earn a dollar, you can do three things with it. You can spend it, save it, invest it. We want to simplify and lower the tax code to make it easier for people to save and invest that money back into the local economy,” said Brady. “And we want to move people from welfare to work.”

Lowering the tax rate for businesses enables them to create new jobs and make capital expenditures, and Brady said the new plan will allow businesses to take the depreciation on the capital equipent the year in which it was purchased, not based on a depreciation schedule spanning several years.

The tax rate for individuals and families would likewise be lowered, and still allow for the mortgage deduction and charitable giving write-off, but reduce the tax on savings and investments, and also eliminate the 'Death Tax.'

One of the added benefits of simplifying income tax is to downsize the IRS per Brady, and break it into three parts:

- A business division for corporations and small businesses

- A division for families and individuals

- A small claims court so tax disputes can be resolved quickly and accurately

"This would provide an IRS that works for the taxpayers, instead of working against them, in addition to trimming the federal budget," Brady said.

Simply put, the Simplified Tax Plan, referred to as "A Better Way," is aimed at reducing the complexity of the code, and the method to file tax return.

“We’re devising a tax filing system so simple and fair that it can fit on a postcard,” said Brady.

Congressman Brady describes the proposed simplified tax plan in the following video…

The Simplified Tax Plan in simple terms by Congressman Kevin Brady

The House Ways and Means Committee is targeting the end of the year to have the bill written. The timeframe to get it passed is in the second half of 2017. Congressman Brady said the best way to get the bill passed is for Americans to speak out. Do so by downloading a copy of the feedback card in the attachments...(Click on See other photos), provide your comment, and mail to Congressman Brady’s office at 200 River Pointe Drive, Suite 304, Conroe, TX (77304-2814), or visit the website at Ways and Means Tax Policy.

Congressman Brady states it's conceivable that the bill to simplify the tax code could be signed into law before the end of 2017.

Additional resources:

www.KevinBrady.House.Gov

#ABetterWay