- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

The Woodlands Township calls for Incorporation Election in November

THE WOODLANDS, TX -- After years of study and numerous public meetings, The Woodlands Township Board of Directors took action today to place Incorporation on the November ballot.

The residents of The Woodlands will have a choice in determining the type of government it wants – to remain as a special purpose district or to become the City of The Woodlands.

Incorporation, essentially, equals the City of The Woodlands, according to Township Chairman Gordy Bunch.

“We have finally reached a point where we have completed all studies and found that the initial tax rate will be equal to what residents are currently paying,” he said. “Incorporation does not include a tax rate increase.”

Since 2018, The Woodlands Township has held nearly 40 Planning Sessions/Special Meetings, has more than 50 video hours of live streaming, recorded and posted on the website, and numerous reports and summaries regarding Incorporation. The Incorporation website can be found here: www.thewoodlandsincorporationstudy.com

“We want to make clear this is a vote by residents of The Woodlands,” Chairman Bunch said. “The residents of The Woodlands will get to vote on their government structure. We need to emphasize if residents decide to vote for City of The Woodlands, annexation by either the cities of Conroe or Houston would forever be eliminated.”

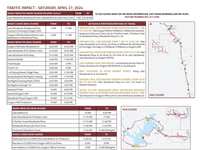

The initial tax rate of Incorporation as the City of The Woodlands was established at 22.31 cents per $100 valuation, which is what taxpayers are paying today in The Woodlands. By law, any tax rate in subsequent years that would exceed 3.5% would require voter approval. The full financial presentation can be found here: View Presentation

The maximum initial tax rate, as proposed, will continue the high quality services currently delivered through The Woodlands Township. In addition, Incorporation initiatives fund full service law enforcement, public works, and provides a tax freeze for residential taxpayers age 65 and older and disabled individuals.

With a flat projection in tax rate, The Woodlands would continue to remain among the lowest in tax rates in comparison among other Texas cities.

By comparison, other city tax rates are as follows:

• The Woodlands — $0.2231

• Sugar Land — $0.3365

• Southlake — $0.4050

• Conroe — $0.4375

• Round Rock — $0.4390

• Frisco — $0.4466

• Allen — $0.4850

• McKinney — $0.5086

• Houston — $0.5679

In 2010, the composite tax rate in The Woodlands was 42 cents per $100 value and this year is 22.31 cents per $100 value, which is a decrease of 47% over the period of 11 years.

Ballot language includes calling for a special election on November 2, 2021, for the Incorporation of The Woodlands Township district into the City of The Woodlands, as a Type-A general-law city, and adopting the maximum initial city property tax rate of 22.31 cents for $100 valuation for the City of The Woodlands. The order also authorizes the transfer of The Woodlands Township district's rights, powers, privileges, duties, purposes, functions, responsibilities, the authority to issue bonds, and the authority to impose taxes from The Woodlands Township district to the City of The Woodlands.

Chairman Bunch said the maximum initial tax rate for incorporation, which is 6.31 cents lower than the rate presented in 2020, is based on stronger than expected sales tax and property tax growth. E-commerce sales tax has increased dramatically since 2019 when the Township received $1.367 million and is projected to collect $4.118 million in 2021.

“The ability to receive sales tax from online purchases has greatly affected the new Incorporation tax rate model,” Bunch said.

The Board has also reduced expenditures this year from $134 million to $128 million.

The Board has a comprehensive 5-year budget plan and a 30-year capital replacement plan for items like parks, pathways, fire department and many other projects.

The original Incorporation model called for a 1% revaluation assumption of properties in The Woodlands. The updated Incorporation model is based on 2% as real estate prices have risen dramatically in the past year and this also reflects five-year trends.

The Township also benefitted from a change in funding methodology for the Capital Replacement Reserve. The Board transfer led $5.5 million to the Capital Replacement Reserve from the Capital Contingency Reserve, which is not recognized by credit rating agencies.

The Board also approved changes in funding methodology for the Township’s Operating Reserve including:

Transferring $7.8 million to the Operating Reserve from the Sales Tax Reserve ($4.3 million) and Capital Contingency Reserve ($3.5 million).

Maintaining a balance in the Operating Reserve equal to 20-25% of general fund operating expenses, which represents 2.5 - 3 months of operations.

Additional funding from annual property tax revenue will not be required during current five-year plan.

Prior to voting on calling an election, the Board reviewed the Incorporation Study Financial Model for determination of a proposed maximum initial tax rate. The updated financial model is based on the Township’s proposed base budget and the addition of incorporation initiatives that were developed as part of the Incorporation Planning Study.

Per the Regional Participation Agreements, and state statute, the Township Board of Directors is vested with the sole authority to call an Incorporation election, which can only be held at a general/uniform election date (November or May). The Woodlands Township Board of Directors can call the election, but only the voters of The Woodlands can decide whether to Incorporate The Woodlands Township as the City of The Woodlands.

The Woodlands Township will conduct community education this fall in advance of the election. Please visit www.thewoodlandstownship-tx.gov and www.thewoodlandsincorporationstudy.com to learn the very latest information on this important topic for The Woodlands.