- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

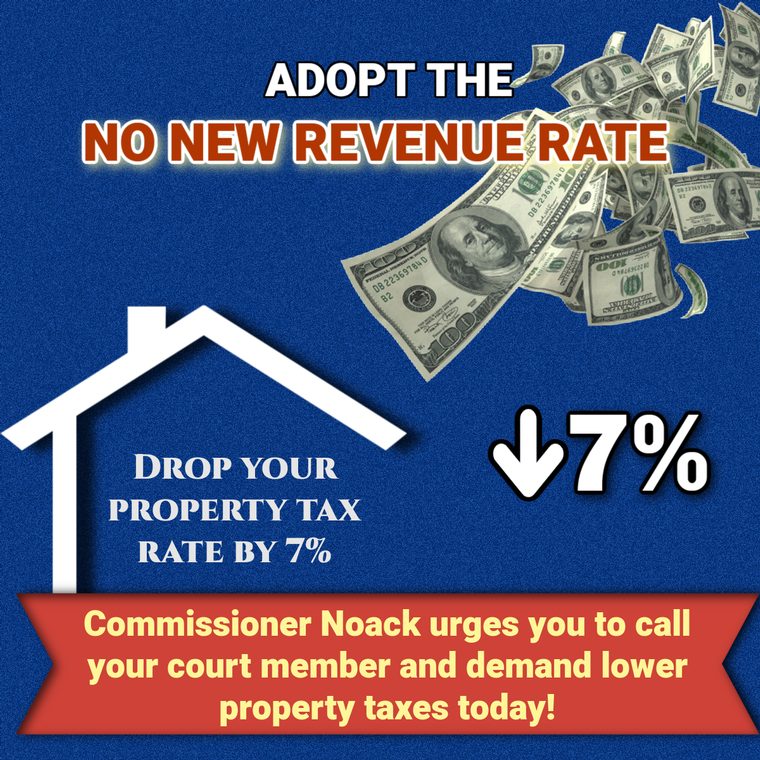

Commissioner Noack proposes No New Revenue tax rate for Montgomery County

THE WOODLANDS, TX -- Montgomery County Commissioner James Noack is urging Montgomery County residents to contact their commissioner and county judge and demand that their elected officials adopt the No New Revenue tax rate of $0.3479.

Adopting the No New Revenue rate would drop the county property tax rate by more the 7 percent from the current rate of $0.3742.

“When I ran for office in 2012, I promised the citizens of Montgomery County that I would be their voice on the Commissioners Court,” Noack said. “Over the last several years, many of our residents have experienced significant financial hardship when it comes to their property taxes, and we as a court need to do everything we can to remain fiscally responsible and assist our residents.”

Commissioner Noack called for a Special Session of Commissioners Court on Tuesday, Aug. 1, in order to discuss his proposal for the No New Revenue rate with court members. Commissioner Noack used the opportunity to speak directly to county residents and request that they let their voices be heard by contacting their precinct commissioner and the county judge.

“I appreciate working with the judge and the court on this issue. But more importantly, I appreciate working with the taxpayers, and really want to talk to them directly today,” Commissioner Noack said during Tuesday’s special court session.”

“At a time when our state spent more time and effort to bring us meaningful property tax reform out of Austin -- we had our lieutenant governor and our governor and all of the legislature work together to come up with a plan that is going to save the taxpayers billions and billions of dollars on their school taxes. And I think that the local Montgomery County taxpayers deserve the same thing here with our Montgomery County tax rate. So if you want your property taxes lowered by 7 percent, contact the court, contact your court members. Let us know that you want to see meaningful property tax reform in Montgomery County. And it can start today, but I need your help. Thank you.”

Commissioner Noack has consistently advocated for county taxpayers since taking office, lowering the county tax rate by more than 22 percent over the past decade.