- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Categories

Impact of Consolidating Muds in the Woodlands

THE WOODLANDS, TX -- There are ten Municipal Utility Districts (MUDs) that govern the Woodlands Water Agency (WWA). The MUDs own the infrastructure that provides local water and sewer services to residents and businesses. The MUDs have no employees but each MUD has five directors, one of which is also a Trustee, that govern the WWA’s approximate 27 full-time equivalent employees. In total, there are 50 directors and ten Trustees.

The WWA operates and maintains local water, sewer, and drainage services to all of The Woodlands MUDs, except Creekside MUD 386. Though within the boundaries of The Woodlands, MUD 386 is largely located in Harris County and is independent of WWA. MUD 386 utilizes water and waste water treatment from facilities jointly operated with MUD 387. Each of the ten MUDs in the WWA purchase water and waste treatment from the San Jacinto River Authority (SJRA). SJRA owns all of the bulk water and sewer treatment facilities, main water and sewer lines, the surface water treatment plant on Lake Conroe, and maintains the large drainage conduits that serve the ten MUDs. SJRA also operates the Lake Conroe dam to regulate water levels.

With incorporation on the ballot for November 2021, many people have questions about the tax or financial impact if the MUDs were consolidated by the City after incorporation. Though there are no official plans for consolidation, some Township Board members believe that, based on consultant studies, consolidating the MUDs would produce substantial savings if the new City could control water, sewer, and drainage for which the MUDs are currently responsible.

Since all MUDs are within the borders of The Woodlands, the new City would have the authority to dissolve or consolidate the MUDs without voter or MUD approval, absorbing all of their assets and liabilities, and to set up its own municipal water, sewer, and drainage services. Creekside MUD 386 is not exempt from possible consolidation by an incorporated Woodlands but it could involve a more complicated process.

Once voter approval of incorporation is certified, the new City of The Woodlands would have four consolidation options:

1. Leave the MUDs as is.

2. Consolidate only some MUDs (likely only those without debt).

3. Consolidate only the ten MUDs which govern the WWA.

4. Consolidate all ten MUDs in WWA plus Creekside MUD 386.

Consolidating only some MUDs in the WWA is impractical as the City would then have its own water and sewer department along with a smaller WWA. Consolidating ten or eleven MUDs would saddle all City property owners with outstanding MUD debts. The last two options pose significant financial and equity concerns.

If the City consolidates ten or eleven MUDs, it:

A. Could not establish a Utility property tax for residents in the consolidated MUDs. The City can only have a single property tax rate applying to all property owners in The Woodlands.

B. Could not refinance all MUD debt as some bonds are not callable or have callable dates in future years. This doesn’t rule out negotiations, but it could be very challenging and probably not worth the cost.

C. Could raise City water and sewer rates as an alternative to raising City property tax rates in order to pay off MUD bonded indebtedness. The Township Chairman stated that this would be the most likely option.

D. Could use consolidated MUD and City reserves to pay down MUD debt for a limited time.

E. Could raise the presently proposed City property tax rate by up to 3.5 percent per year in future years, without voter approval (or more with voter approval), to make up for the elimination of MUD property tax rates

F. Could impose some combination of increase in City property taxes and increases in water and sewer rates.

All non-exempt Township property owners currently pay both MUD and Township property taxes. If some or all of the MUDs were not consolidated, property owners would still pay MUD property taxes in those MUDs as well as City property taxes.

All MUDs, except MUD 386, currently have a 20 percent homestead exemption plus some MUDs have an additional exemption for owners over 65 or disabled. The Township currently has no exemptions in either category but a senior and disabled tax freeze is proposed if The Woodlands becomes a city.

If MUDs are consolidated, the only practical alternatives are consolidating the ten MUDs in the WWA or all eleven MUDs in the new City. As previously noted, this would eliminate MUD property taxes for these ten or eleven MUDs. The following section illustrates the impact of consolidation if City property taxes, alone, were raised to pay off bonded indebtedness

Expense Savings of MUD Consolidation

Based on a Spring 2021 MUD 1 and 6 consolidation study, if the ten MUDs in the WWA were consolidated, there would be approximately $66,000 in direct annual cash savings per MUD, or about $87,000 per MUD if both cash and elimination of WWA staff hours and resources spent on MUD and trustee meetings (soft benefits) were included . At best, by eliminating the MUDs, there would be a total annual cash savings of $660,000 or, if soft benefits are included, savings of about $870,000 per year, compared to the $63 million fiscal year 2021-2022 expense budgets of the ten Township MUDs.

Stifel Investment Banking Company, in a Township funded study estimated consolidation savings of $1.6 million, but the study does not net these savings against utility related cost increases to the new City. All or portions of the eight expense categories would still be incurred by the City. Using only the more conservative numbers developed by MUD 1 and MUD 6, potential cost savings represent a 1.0 percent cash and 1.4 percent cash plus soft benefit reduction in costs, respectively, excluding MUD 386.

Tax Impact of MUD Consolidation

Tax rates are set based on assessed property values and income needed for debt repayment and fixed operating costs. Assessed values for each MUD include property, improvements, and personal property for both residences and property deemed commercial. At least seven classes of properties are exempt from MUD taxes, however, such as a church. Exempt property values must be subtracted from total assessed property values in order to determine net taxable assets.

If the MUDs were consolidated with a single tax rate to pay off debt, there would be winners and losers. The losers are property owners within MUDs that currently have little or no outstanding debt and low tax rates. Their taxes would increase in order to subsidize obligations of property owners in MUDs with significant outstanding debt and higher tax rates. The winners are property owners whose taxes would be reduced at the expense of the losers.

To determine a single tax rate for consolidated MUDs that would generate the same tax revenue, the total required property tax revenue amount is divided by the grand total of non-exempt property asset values. (A person or entity may own one or more properties and may or may not have a Woodlands address.) The source of information for the ten MUDs in the WWA is from the Assessment Roll Grand Totals Report for 2021, maintained by the WWA and financial reports prepared by WWA for each MUD. Numbers for MUD 386 were provide by MUD 386, Masterson Advisors, LLC, and Municipal Accounts & Consulting, L.P. Numbers in this study may vary from the Township funded studies due to time differences or use of different sources of information.

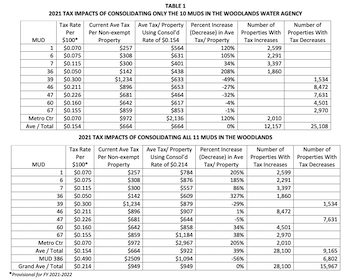

Results of consolidation with a single tax rate and no change in the debt structure are shown in Table 1 for only the ten MUDs in the WWA. The Table shows that there would be would a significant change in average tax payments per property. If only the ten MUDs in the WWA were consolidated, some properties would experience up to a three-fold increase in MUD related taxes. Some properties would experience little change or up to nearly a 50 percent reduction in MUD related taxes. If MUD 386 was not included in the consolidation, about 12,160 properties would see tax increases and about 25,110 properties would see decreases. The consolidated FY 2021-2022 tax rate for only the ten MUDs in the WWA would be about $0.154 per $100 of net assessed value.

If MUD 386 was included in the consolidation, as shown in the bottom part of Table 1, some properties would experience over a four-fold increase in MUD related taxes, whereas some other properties would experience a 30 percent reduction in their current MUD related tax. If MUD 386 were included, the consolidated tax rate would be $.214 per $100 of net assessed value. If MUD 386 was included in the consolidation, about 19,600 properties would see significant tax increases, about 8,300 would see decreases, and 16,100 would see relatively little change.

Consolidating MUDs that have comparable balance sheets, tax rates, and similar asset relationships greatly reduces tax disparities, as the successful 2016 consolidation of former MUD 2 and MUD 40 into The Woodlands MUD 1 demonstrated. This success has encouraged the Boards of MUD 1 and MUD 6 to propose consolidation, to be voted on by residents in these two MUDs on November 2, 2021 or during early voting.

User Fee Options to Recovering MUD Property Tax Revenue (Option C above)

A City-wide increase in water and sewer rates is the most likely vehicle to replace current MUD property taxes and pay off bond debt obligations. Alternatively, the City could utilize all or part of MUD and City reserves to pay down some debt. Since the incorporation plan does not specifically address the MUDs, there are many unanswered questions of exactly how the City would pay down MUD debt. No matter how the City approaches this, residents will be impacted differently, with winners and losers. Also, switching from predictable tax-financed debt reduction to a less predictable water and sewer rate income has drawbacks. First, it would have different impacts on property owners, depending on their water use. Second, greatly increased water and sewer rates will be a major deterrent to water use (an ecological benefit, however), and an unpredictable income source for debt repayment.

Impact of Reserves in MUD Consolidation

Table 2 [not able to display] is a summary of cash reserves that the new City would assume if the MUDs were absorbed by it. There is a total of $90.0 Million in reserves among the eleven (11) MUDs. MUDs are required by law to use these reserves to support the provision of water, sewer and drainage. If the MUDs were consolidated, these reserves could be consolidated into the city’s budget and even used to offset shortfalls in other City services. It is not possible to calculate the financial impact without knowing what the new City might do, but, again, there still would be winners and losers among property owners.

Table 3 [not able to display is a summary of bonded indebtedness for MUDs with outstanding debt as of July 31, 2021 and scheduled bond payments for the calendar year 2022. Bond indebtedness of the ten MUDs in the WWA was $135.7 million as of July 31, 2021. MUD 386 bond debt was about $145.6 million. Annual bond debt and interest payments currently are budgeted at $16.6 million for the ten MUDs in WWA for the year 2022. MUD 386 budgeted debt payments for 2022 are $11.3 million.

Impact of Incorporation on Drainage and Flooding

Both the Township and the MUDs have authority regarding drainage issues and related local flood prevention, though the Township claims it has no such authority. The Enabling Legislation authoring the creation of The Woodlands Township (Senate Bill 1373, 1993) includes within its definition of an Improvement Project; “drainage or storm water detention improvements” and “the removal, razing, demolition, or clearing of land or improvements in connection with any improvement project” and “the acquisition of real or personal property or any interest therein in connection with an authorized improvement project…. for the improvement and promotion of the district or adjacent areas or for the protection of public health and safety within or adjacent to the district.”

Consolidation of the MUDs often has been touted as an advantage to incorporate. However, the Township Board chose not to include water and sewer in its incorporation plan. There are many questions that should be answered about if, how, and when consolidation should be accomplished. The disparities in debt and reserves make it impossible to fairly consolidate at this time without affecting water and sewer costs differently among property owners. Perhaps the best way to consolidate MUDs is to wait until the MUDs obligations are paid down and MUD property tax rates are similar. Forced consolidation of the MUDs is not a reason to support incorporation.

Debt Reduction Options to Mitigate Property Tax increases

Some or all of the reserves from the consolidated MUD’s and / or the City could be used to pay down some of the debt currently owed by seven MUDs within WWA (and by MUD 386, if it were included in the consolidation). Alternatively, as previously noted, the City could raise water and sewer rates and refinance callable bonds.

Conclusion

In summary, consolidating MUDs does not appear to be a big money saver for the City or a reason supporting incorporation. But what is certain that MUD consolidation soon after incorporation will affect property owners very differently

Robert Leilich is currently President of The Woodlands MUD 1 and is a member of the Township Drainage Task Force. This article is his personal work with data provided as referenced. This article does not necessarily represent the views or opinions of The Woodlands MUD 1, the Woodlands Water Agency, the Township Drainage Task Force, MUD 386 or any other organization.

The WWA operates and maintains local water, sewer, and drainage services to all of The Woodlands MUDs, except Creekside MUD 386. Though within the boundaries of The Woodlands, MUD 386 is largely located in Harris County and is independent of WWA. MUD 386 utilizes water and waste water treatment from facilities jointly operated with MUD 387. Each of the ten MUDs in the WWA purchase water and waste treatment from the San Jacinto River Authority (SJRA). SJRA owns all of the bulk water and sewer treatment facilities, main water and sewer lines, the surface water treatment plant on Lake Conroe, and maintains the large drainage conduits that serve the ten MUDs. SJRA also operates the Lake Conroe dam to regulate water levels.

With incorporation on the ballot for November 2021, many people have questions about the tax or financial impact if the MUDs were consolidated by the City after incorporation. Though there are no official plans for consolidation, some Township Board members believe that, based on consultant studies, consolidating the MUDs would produce substantial savings if the new City could control water, sewer, and drainage for which the MUDs are currently responsible.

Since all MUDs are within the borders of The Woodlands, the new City would have the authority to dissolve or consolidate the MUDs without voter or MUD approval, absorbing all of their assets and liabilities, and to set up its own municipal water, sewer, and drainage services. Creekside MUD 386 is not exempt from possible consolidation by an incorporated Woodlands but it could involve a more complicated process.

Once voter approval of incorporation is certified, the new City of The Woodlands would have four consolidation options:

1. Leave the MUDs as is.

2. Consolidate only some MUDs (likely only those without debt).

3. Consolidate only the ten MUDs which govern the WWA.

4. Consolidate all ten MUDs in WWA plus Creekside MUD 386.

Consolidating only some MUDs in the WWA is impractical as the City would then have its own water and sewer department along with a smaller WWA. Consolidating ten or eleven MUDs would saddle all City property owners with outstanding MUD debts. The last two options pose significant financial and equity concerns.

If the City consolidates ten or eleven MUDs, it:

A. Could not establish a Utility property tax for residents in the consolidated MUDs. The City can only have a single property tax rate applying to all property owners in The Woodlands.

B. Could not refinance all MUD debt as some bonds are not callable or have callable dates in future years. This doesn’t rule out negotiations, but it could be very challenging and probably not worth the cost.

C. Could raise City water and sewer rates as an alternative to raising City property tax rates in order to pay off MUD bonded indebtedness. The Township Chairman stated that this would be the most likely option.

D. Could use consolidated MUD and City reserves to pay down MUD debt for a limited time.

E. Could raise the presently proposed City property tax rate by up to 3.5 percent per year in future years, without voter approval (or more with voter approval), to make up for the elimination of MUD property tax rates

F. Could impose some combination of increase in City property taxes and increases in water and sewer rates.

All non-exempt Township property owners currently pay both MUD and Township property taxes. If some or all of the MUDs were not consolidated, property owners would still pay MUD property taxes in those MUDs as well as City property taxes.

All MUDs, except MUD 386, currently have a 20 percent homestead exemption plus some MUDs have an additional exemption for owners over 65 or disabled. The Township currently has no exemptions in either category but a senior and disabled tax freeze is proposed if The Woodlands becomes a city.

If MUDs are consolidated, the only practical alternatives are consolidating the ten MUDs in the WWA or all eleven MUDs in the new City. As previously noted, this would eliminate MUD property taxes for these ten or eleven MUDs. The following section illustrates the impact of consolidation if City property taxes, alone, were raised to pay off bonded indebtedness

Expense Savings of MUD Consolidation

Based on a Spring 2021 MUD 1 and 6 consolidation study, if the ten MUDs in the WWA were consolidated, there would be approximately $66,000 in direct annual cash savings per MUD, or about $87,000 per MUD if both cash and elimination of WWA staff hours and resources spent on MUD and trustee meetings (soft benefits) were included . At best, by eliminating the MUDs, there would be a total annual cash savings of $660,000 or, if soft benefits are included, savings of about $870,000 per year, compared to the $63 million fiscal year 2021-2022 expense budgets of the ten Township MUDs.

Stifel Investment Banking Company, in a Township funded study estimated consolidation savings of $1.6 million, but the study does not net these savings against utility related cost increases to the new City. All or portions of the eight expense categories would still be incurred by the City. Using only the more conservative numbers developed by MUD 1 and MUD 6, potential cost savings represent a 1.0 percent cash and 1.4 percent cash plus soft benefit reduction in costs, respectively, excluding MUD 386.

Tax Impact of MUD Consolidation

Tax rates are set based on assessed property values and income needed for debt repayment and fixed operating costs. Assessed values for each MUD include property, improvements, and personal property for both residences and property deemed commercial. At least seven classes of properties are exempt from MUD taxes, however, such as a church. Exempt property values must be subtracted from total assessed property values in order to determine net taxable assets.

If the MUDs were consolidated with a single tax rate to pay off debt, there would be winners and losers. The losers are property owners within MUDs that currently have little or no outstanding debt and low tax rates. Their taxes would increase in order to subsidize obligations of property owners in MUDs with significant outstanding debt and higher tax rates. The winners are property owners whose taxes would be reduced at the expense of the losers.

To determine a single tax rate for consolidated MUDs that would generate the same tax revenue, the total required property tax revenue amount is divided by the grand total of non-exempt property asset values. (A person or entity may own one or more properties and may or may not have a Woodlands address.) The source of information for the ten MUDs in the WWA is from the Assessment Roll Grand Totals Report for 2021, maintained by the WWA and financial reports prepared by WWA for each MUD. Numbers for MUD 386 were provide by MUD 386, Masterson Advisors, LLC, and Municipal Accounts & Consulting, L.P. Numbers in this study may vary from the Township funded studies due to time differences or use of different sources of information.

Results of consolidation with a single tax rate and no change in the debt structure are shown in Table 1 for only the ten MUDs in the WWA. The Table shows that there would be would a significant change in average tax payments per property. If only the ten MUDs in the WWA were consolidated, some properties would experience up to a three-fold increase in MUD related taxes. Some properties would experience little change or up to nearly a 50 percent reduction in MUD related taxes. If MUD 386 was not included in the consolidation, about 12,160 properties would see tax increases and about 25,110 properties would see decreases. The consolidated FY 2021-2022 tax rate for only the ten MUDs in the WWA would be about $0.154 per $100 of net assessed value.

If MUD 386 was included in the consolidation, as shown in the bottom part of Table 1, some properties would experience over a four-fold increase in MUD related taxes, whereas some other properties would experience a 30 percent reduction in their current MUD related tax. If MUD 386 were included, the consolidated tax rate would be $.214 per $100 of net assessed value. If MUD 386 was included in the consolidation, about 19,600 properties would see significant tax increases, about 8,300 would see decreases, and 16,100 would see relatively little change.

Consolidating MUDs that have comparable balance sheets, tax rates, and similar asset relationships greatly reduces tax disparities, as the successful 2016 consolidation of former MUD 2 and MUD 40 into The Woodlands MUD 1 demonstrated. This success has encouraged the Boards of MUD 1 and MUD 6 to propose consolidation, to be voted on by residents in these two MUDs on November 2, 2021 or during early voting.

User Fee Options to Recovering MUD Property Tax Revenue (Option C above)

A City-wide increase in water and sewer rates is the most likely vehicle to replace current MUD property taxes and pay off bond debt obligations. Alternatively, the City could utilize all or part of MUD and City reserves to pay down some debt. Since the incorporation plan does not specifically address the MUDs, there are many unanswered questions of exactly how the City would pay down MUD debt. No matter how the City approaches this, residents will be impacted differently, with winners and losers. Also, switching from predictable tax-financed debt reduction to a less predictable water and sewer rate income has drawbacks. First, it would have different impacts on property owners, depending on their water use. Second, greatly increased water and sewer rates will be a major deterrent to water use (an ecological benefit, however), and an unpredictable income source for debt repayment.

Impact of Reserves in MUD Consolidation

Table 2 [not able to display] is a summary of cash reserves that the new City would assume if the MUDs were absorbed by it. There is a total of $90.0 Million in reserves among the eleven (11) MUDs. MUDs are required by law to use these reserves to support the provision of water, sewer and drainage. If the MUDs were consolidated, these reserves could be consolidated into the city’s budget and even used to offset shortfalls in other City services. It is not possible to calculate the financial impact without knowing what the new City might do, but, again, there still would be winners and losers among property owners.

Table 3 [not able to display is a summary of bonded indebtedness for MUDs with outstanding debt as of July 31, 2021 and scheduled bond payments for the calendar year 2022. Bond indebtedness of the ten MUDs in the WWA was $135.7 million as of July 31, 2021. MUD 386 bond debt was about $145.6 million. Annual bond debt and interest payments currently are budgeted at $16.6 million for the ten MUDs in WWA for the year 2022. MUD 386 budgeted debt payments for 2022 are $11.3 million.

Impact of Incorporation on Drainage and Flooding

Both the Township and the MUDs have authority regarding drainage issues and related local flood prevention, though the Township claims it has no such authority. The Enabling Legislation authoring the creation of The Woodlands Township (Senate Bill 1373, 1993) includes within its definition of an Improvement Project; “drainage or storm water detention improvements” and “the removal, razing, demolition, or clearing of land or improvements in connection with any improvement project” and “the acquisition of real or personal property or any interest therein in connection with an authorized improvement project…. for the improvement and promotion of the district or adjacent areas or for the protection of public health and safety within or adjacent to the district.”

Consolidation of the MUDs often has been touted as an advantage to incorporate. However, the Township Board chose not to include water and sewer in its incorporation plan. There are many questions that should be answered about if, how, and when consolidation should be accomplished. The disparities in debt and reserves make it impossible to fairly consolidate at this time without affecting water and sewer costs differently among property owners. Perhaps the best way to consolidate MUDs is to wait until the MUDs obligations are paid down and MUD property tax rates are similar. Forced consolidation of the MUDs is not a reason to support incorporation.

Debt Reduction Options to Mitigate Property Tax increases

Some or all of the reserves from the consolidated MUD’s and / or the City could be used to pay down some of the debt currently owed by seven MUDs within WWA (and by MUD 386, if it were included in the consolidation). Alternatively, as previously noted, the City could raise water and sewer rates and refinance callable bonds.

Conclusion

In summary, consolidating MUDs does not appear to be a big money saver for the City or a reason supporting incorporation. But what is certain that MUD consolidation soon after incorporation will affect property owners very differently

Robert Leilich is currently President of The Woodlands MUD 1 and is a member of the Township Drainage Task Force. This article is his personal work with data provided as referenced. This article does not necessarily represent the views or opinions of The Woodlands MUD 1, the Woodlands Water Agency, the Township Drainage Task Force, MUD 386 or any other organization.

Comments •