- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Tax Cuts and Jobs Act: One Year Later

WASHINGTON, D.C. -- This week marks the one-year anniversary of the Tax Cuts and Jobs Act being signed into law. This historic reform of America’s tax code, the first in thirty-one years, has re-vitalized the American economy – creating jobs, increasing wages, and encouraging investment.

Just one-year out, the positive changes our new tax code created for American families and small businesses are undeniable. The Tax Cuts and Jobs Act has changed the trajectory of the economy for the better.

Before President Trump signed these historic reforms into law, growth was slow and wages were stagnant. American families saw too much of their hard-earned money being swept away by the federal government. The nonpartisan Congressional Budget Office (CBO) estimated GDP growth would be stuck hovering around the slow-growth levels that were the "new normal" developed under the Obama administration.

Refusing to accept the status quo, Republicans took action and created a tax code that put families and local businesses first, not Washington special interests. And one year out, that “new normal” is now a thing of the past. In the third quarter of 2018, the American economy grew at a rate of 3.5%. America is on track for an annual growth rate near 3% for this year, a first since 2005.

At the same time, Main Street optimism has reached historic levels. Without the burden of an uncompetitive tax code, American small businesses have been able to hire more workers, increase wages, and re-invest in their businesses.

The good news doesn’t stop there:

Wages are up 3.1 percent, their fastest pace in nearly a decade.

Consumer confidence hit an 18-year high this year.

Unemployment remains at its lowest level in nearly 50 years.

There are over 7 million job openings.

State and local governments are investing more in their communities due to increased revenue.

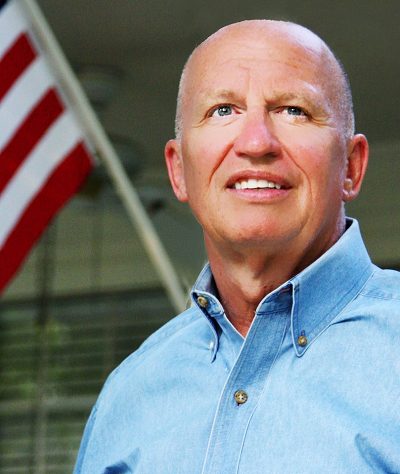

As Ways and Means Committee Chairman Kevin Brady (R-TX) has said, “the best is still yet to come.” This tax code was built for the long term, and House Republicans are committed to building on its successes so that our workers and small businesses can continue to reap the benefits of this strong economy in the years to come.