- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Categories

OPINION: The Woodlands Township Board should return $20.8 million Incorporation Reserve to taxpayers

THE WOODLANDS, TX - The Woodlands Township Board of Directors scheduled an election in November 2021 for The Woodlands residents to vote on whether we should incorporate The Woodlands into a city. Voters overwhelmingly rejected incorporation, with over two-thirds voting against it. So why is the Board still saving tax dollars for incorporation?

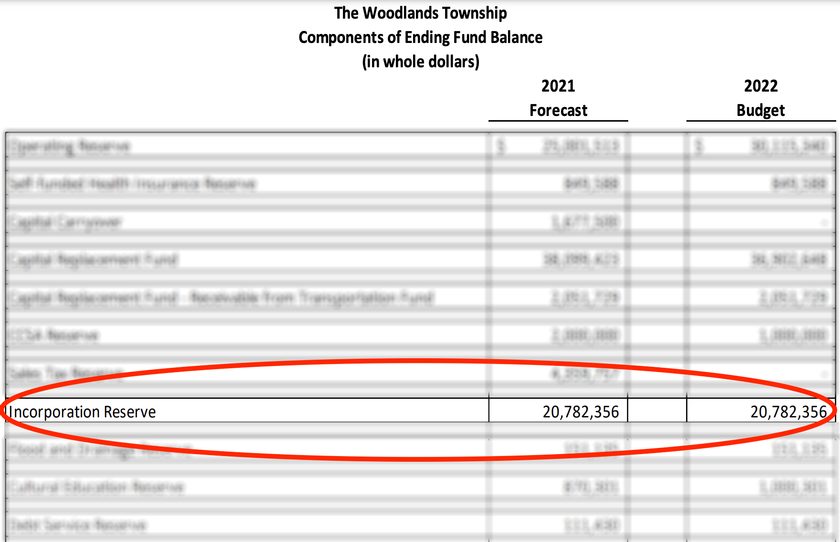

The Township Board has maintained an “Incorporation Reserve” fund that stands at roughly $20,782,356 as of the 2022 adopted budget**. Since the end of 2019, the Board has maintained over $20 million of capital reserves between a 'Grogan's Mill Property Site Plan Reserve' (for a new city hall) and its incorporation reserve. The value of that money that is just sitting there is shrinking every day due to historic inflation, and it is clear that the large majority of voters in The Woodlands do not wish to incorporate.

Therefore, the Board should return the incorporation reserve in full to taxpayers immediately by issuing a $20.8 million rebate in the form of a one-year property tax rate reduction, similar to the 2007 rebate issued by The Woodlands Community Association.

Since the 2016 start of a push to incorporate led by The Woodlands Township Board Chairman Gordy Bunch, the Board quietly built incorporation capital reserves by repeatedly overestimating expenditures or underestimating revenues in their annual budget planning sessions. When they had money left over at the end of the year, instead of using it to lower property taxes, they put it in their incorporation reserves to buy down the future costs of a potential incorporation.

These funds were to be used to offset the initial large costs that The Woodlands would incur upon incorporating into a city. As such, the fund was also used to lower the proposed maximum initial property tax rate that a 'City of The Woodlands' would adopt upon incorporation. This tax rate was then presented to voters on the ballot for incorporation.

In other words, the Township Board used this fund to make incorporation appear less costly to The Woodlands voters on the ballot. In reality, we were already paying for it all along, without our consent!

In addition to spending $1,411,300 on incorporation studies, the Board’s incorporation fund has also cost taxpayers over $3 million due to inflation* since the start of 2020. Was this a good use of our tax dollars? At least two-thirds of The Woodlands voters would probably say 'no'.

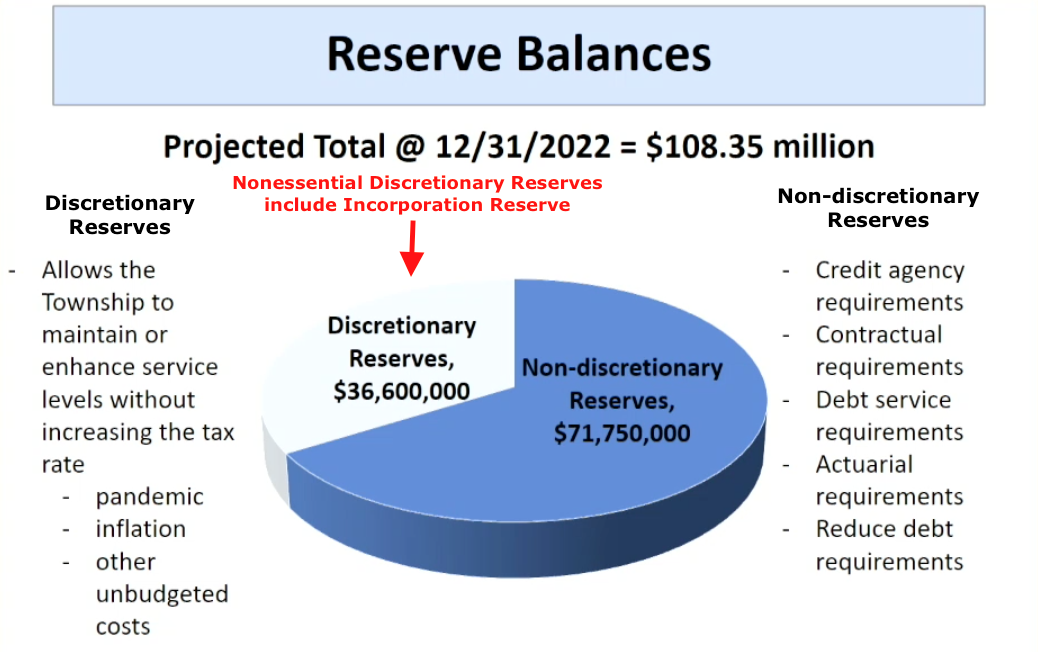

The Township Board should rebate the incorporation reserve in full to taxpayers this budget cycle with a one-year property tax rate reduction of $.0835 per $100 of taxable property value (based on $24.9B property value per the 2023 preliminary budget***). This will prevent more inflationary shrinkage of the value of those tax dollars and help alleviate some of the pain from inflation that taxpayers are dealing with at the grocery store and the gas pump at this time. With $108,350,000 of capital reserves (including $36,600,000 of discretionary reserves) and a budget of $132,335,901 in 2022 per the June 2022 Budget Planning Session, this should not be a question.

And let’s not forget, we should all expect the Board to significantly reduce the Township property tax rate in September in order to prevent an increase in taxes following a huge 15.4% estimated increase in the total value of taxable property in The Woodlands in 2022. The effective property tax rate, AKA the no new revenue rate, was recently announced by the Township to be $.1964 per $100 property value. Including an incorporation reserve rebate of $.0835 and a reduction of the current property tax rate of $.2231 to the effective rate $.1964 per $100, The Woodlands 2023 property tax rate should be around $.1129 per $100.

Yours truly,

Bruce Tough

Former Chairman, The Woodlands Township Board of Directors

*Conservative incorporation capital reserves inflation cost calculated with the Bureau of Labor Statistics CPI Inflation Calculator using an input of $20.52 million starting in January 2020 and ending June 2022.

**Budget and incorporation reserve data gathered from The Woodlands Township 2022 Adopted Budget Summary.

***See The Woodlands Township 2023 Preliminary Budget.

The Township Board has maintained an “Incorporation Reserve” fund that stands at roughly $20,782,356 as of the 2022 adopted budget**. Since the end of 2019, the Board has maintained over $20 million of capital reserves between a 'Grogan's Mill Property Site Plan Reserve' (for a new city hall) and its incorporation reserve. The value of that money that is just sitting there is shrinking every day due to historic inflation, and it is clear that the large majority of voters in The Woodlands do not wish to incorporate.

Therefore, the Board should return the incorporation reserve in full to taxpayers immediately by issuing a $20.8 million rebate in the form of a one-year property tax rate reduction, similar to the 2007 rebate issued by The Woodlands Community Association.

Since the 2016 start of a push to incorporate led by The Woodlands Township Board Chairman Gordy Bunch, the Board quietly built incorporation capital reserves by repeatedly overestimating expenditures or underestimating revenues in their annual budget planning sessions. When they had money left over at the end of the year, instead of using it to lower property taxes, they put it in their incorporation reserves to buy down the future costs of a potential incorporation.

These funds were to be used to offset the initial large costs that The Woodlands would incur upon incorporating into a city. As such, the fund was also used to lower the proposed maximum initial property tax rate that a 'City of The Woodlands' would adopt upon incorporation. This tax rate was then presented to voters on the ballot for incorporation.

In other words, the Township Board used this fund to make incorporation appear less costly to The Woodlands voters on the ballot. In reality, we were already paying for it all along, without our consent!

In addition to spending $1,411,300 on incorporation studies, the Board’s incorporation fund has also cost taxpayers over $3 million due to inflation* since the start of 2020. Was this a good use of our tax dollars? At least two-thirds of The Woodlands voters would probably say 'no'.

The Township Board should rebate the incorporation reserve in full to taxpayers this budget cycle with a one-year property tax rate reduction of $.0835 per $100 of taxable property value (based on $24.9B property value per the 2023 preliminary budget***). This will prevent more inflationary shrinkage of the value of those tax dollars and help alleviate some of the pain from inflation that taxpayers are dealing with at the grocery store and the gas pump at this time. With $108,350,000 of capital reserves (including $36,600,000 of discretionary reserves) and a budget of $132,335,901 in 2022 per the June 2022 Budget Planning Session, this should not be a question.

And let’s not forget, we should all expect the Board to significantly reduce the Township property tax rate in September in order to prevent an increase in taxes following a huge 15.4% estimated increase in the total value of taxable property in The Woodlands in 2022. The effective property tax rate, AKA the no new revenue rate, was recently announced by the Township to be $.1964 per $100 property value. Including an incorporation reserve rebate of $.0835 and a reduction of the current property tax rate of $.2231 to the effective rate $.1964 per $100, The Woodlands 2023 property tax rate should be around $.1129 per $100.

Yours truly,

Bruce Tough

Former Chairman, The Woodlands Township Board of Directors

*Conservative incorporation capital reserves inflation cost calculated with the Bureau of Labor Statistics CPI Inflation Calculator using an input of $20.52 million starting in January 2020 and ending June 2022.

**Budget and incorporation reserve data gathered from The Woodlands Township 2022 Adopted Budget Summary.

***See The Woodlands Township 2023 Preliminary Budget.

Comments •