- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Categories

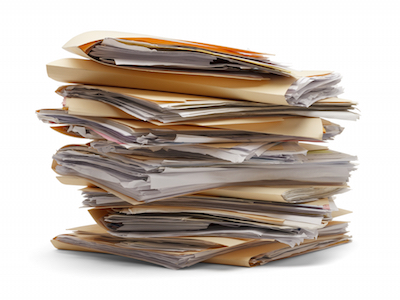

Don’t get overtaxed when preparing your year-end tax documents

THE WOODLANDS, TX (December 16, 2015) – Although the deadline for filing taxes won’t be for four months – or ten, if you file for and are granted an extension – the shifting financial climate is encouraging people to file as soon as possible in hopes of a tax refund seeing them through the new year. With the changing landscape in how taxes are filed, particularly the ongoing growing complexities of the Affordable Care Act, known to most as “Obamacare,” there could be significant legal issues for taxpayers who don’t maintain the proper related documentation.

New online legal portal assists taxpayers in navigating the taxing tax landscape

“While these documents are needed for the typical filing of tax returns, they are absolutely vital to be available and in order if the taxpayer finds himself or herself on the receiving end of a tax audit or other legal entanglement that the Internal Revenue Service might levy,” said Bill Voss, owner of The Voss Law Firm, P.C.

Knowing how important it is to not only be able to immediately retain legal counsel in a taxing situation, but also to be able to select the proper attorney for your particular needs, Voss helped create HireMeLegal.com to remove the stress and guesswork. Should you find yourself contacted by the IRS and in need of legal assistance, he recommends that you immediately retain legal counsel by posting your legal issue on the website www.HireMeLegal.com.

“A CPA or tax service can help unstrangle some of your mistakes that have been made by accident and lessen the impact, but they can’t legally represent you in official legal matters; only an attorney can do that with full effectiveness,” he said.

Voss points out five tax-related documents in particular for you to hold on to and keep in an accessible file in case of legal issues:

W-2 Forms – W-2s are issued by employers that show income, taxes taken out, and other data that are essential for filing. Ensure to bring W-2s for every person in the household and for every job held in 2014.

1099s – This form shows other income such as unemployment, social security, school loans, health care reimbursement, interest income, dividends, sale of stock or income from contract work.

1098s – This form will show any payments made such as mortgage interest, property taxes or school loans.

Income Statements – Statements of all payments and expense related to self-employment, including cash receipts, credit card receipts and an items reported on the filer’s 1099s. Bring any statements of income or interest from savings accounts and investments.

Proof of Deductions - Any documentation that proves deductions you may claim, including charitable gifts and miles, alimony, child care payments, moving expenses, medical and dental expenses, and medical miles.,

By logging on to HireMeLegal.com, users can register and post their legal issue for free. Qualified attorneys with the right experience and skills reach out and bid for the chance to take on the case. Users can also search HireMeLegal.com’s directory of thousands of top tier attorneys and initiate contact themselves. Clients can search by legal specialization, geographical location and user rating. The process is secure, and no personal details are displayed when a user posts a case.

HireMeLegal.com was founded in The Woodlands, Texas and serves clients nationally, helping many different types of clients with legal issues ranging from automobile accidents to drafting wills. For more information, visit www.HireMeLegal.com for free case evaluations.

Comments •