- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Categories

HFG Investment Update: Elections and Markets

THE WOODLANDS, TX - As we move into the fourth quarter of 2020 and into the ”stretch run” prior to the Presidential election, we have gotten a number of questions about whether we should be changing our investment stance because of the potential uncertainty on financial markets. A recent survey has shown that 45% of investors said they plan to make changes to their investments because of the election. However, elections haven't impacted the market as much as you may think and if recent history is any guide, this may not be a wise decision.

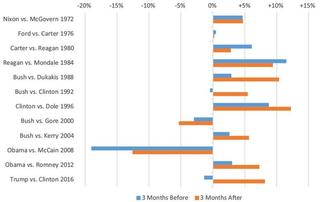

For the past 12 presidential elections, the S&P 500 Index has generally been positive 90 days before and after Election Day. As the chart below shows, markets have generally responded positively regardless of which party wins the election. The most notable exception was in 2008, which was in the midst of the Financial Crisis.

The S&P returned a positive 1.4% in the 90 days prior to the election, and 4.0% in the 90 days after the election. For point of reference, the S&P is up approximately 1.7% since August 4th, which is on track with historical norms.

While this is a relatively small sample size, it does illustrate the point that market performance tends to follow economic conditions over time, and that singular events like elections tend not to matter over the longer term. The bottom line is that market returns are more dependent on the outlook for the economy than on the outcome of the election.

For the past 12 presidential elections, the S&P 500 Index has generally been positive 90 days before and after Election Day. As the chart below shows, markets have generally responded positively regardless of which party wins the election. The most notable exception was in 2008, which was in the midst of the Financial Crisis.

The S&P returned a positive 1.4% in the 90 days prior to the election, and 4.0% in the 90 days after the election. For point of reference, the S&P is up approximately 1.7% since August 4th, which is on track with historical norms.

While this is a relatively small sample size, it does illustrate the point that market performance tends to follow economic conditions over time, and that singular events like elections tend not to matter over the longer term. The bottom line is that market returns are more dependent on the outlook for the economy than on the outcome of the election.

Comments •