- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Categories

RECAP: Incorporation Informational Meeting Hosted by The Woodlands Township

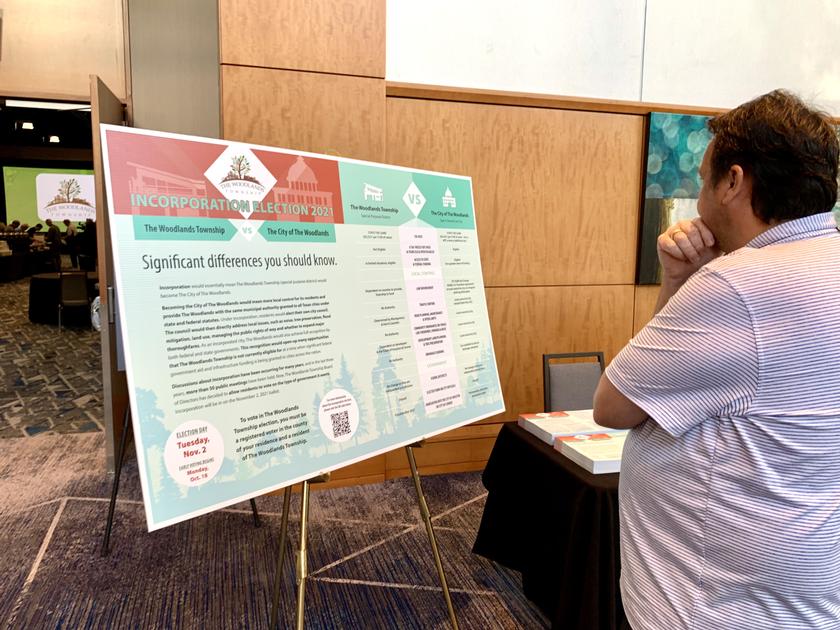

THE WOODLANDS, TX — The Woodlands Township invited the public to its Incorporation Informational Meeting, which took place at 6:00 p.m. Sept. 23 at The Woodlands Waterway Marriott and Convention Center.

A video of the meeting can be viewed here.

The night included a general presentation, which was provided by Township Chairman, Gordy Bunch, as well as representatives from the Township’s consulting team, The Novak Consulting Group, newly acquired by Raftelis.

Executive Vice President, Julia D. Novak, and Senior Manager Jonathan Ingram, discussed in detail Incorporation Study Goals and Approach, as well as Incorporation Study Findings; Revenue Under Incorporation, Law Enforcement, Infrastructure/Public Works, General Government, and Tax Rate Impact.

Following the presentation, residents had the opportunity to split into four “breakout areas” that covered Governance, Infrastructure, Law Enforcement, and Finance. At each station, residents were asked to write their questions down on an index card. The cards were then read aloud and addressed. Chairman Bunch stated that these questions/answers will be placed under a separate tab on the Township’s Incorporation Study website. The questions they were unable to get to will be included as well.

Novak provided a summary of resident questions, which included:

• Governance: Local control - Who would have control under a City or a Township? Who would control infrastructure and decisions about roadways? What would happen if The Woodlands Mall needed to be redeveloped?

• Infrastructure: The question of control was raised again - Who would control the right-of-ways? Who would be in charge of maintenance?

• Law Enforcement: There seemed to be a lot of questions about Creekside Park, and ensuring the current level of service and care.

• Finance: Questions were geared toward the incorporation reserve funds and whether or not it could be used to lower taxes, as well as franchise fees - How will they be passed on to consumers?

Current FAQs regarding Incorporation, provided by the Township.

Follow this link to add a question of your own.

| An overview provided by The Woodlands Township |

GOVERNANCE

Current provider: The Woodlands Township

• The Woodlands Township is a Special Purpose District authorized by the State to enhance basic services provided by other agencies (e.g. counties)

Proposed Provider: City of The Woodlands

• A City of The Woodlands would be incorporated first as a General Law City, with the option to become a Home Rule City at a later date

- General Law Cities provide services explicitly authorized by the State

- Home Rule Cities derive authority from voter-approval charters and may act

unless restricted by the State

Incorporation Impact(s):

• Preserves identity of The Woodlands

• Expands local control over ordinances, taxes, building code, public safety, court, regional partnerships, and emergency response

• Increased responsibility for infrastructure and services

TOTAL COST OF SERVICE AND REVENUE IMPACT

Incorporation Impact(s):

• City eligible for additional revenue sources (franchise fees, alcohol and beverage tax, grants)

• City's ability to spend hotel occupancy tax is more constrained than Township

• Recent revenue growth has remained strong

• Existing reserves may be used to offset future capital costs

• Incorporation initiatives approved by the Board can be implemented with no impact on maximum tax rate, based on projected revenue growth

• Assumes implementation of property tax ceiling for residents aged 65+/disabled

Costs:

• Approximately $16.8 million in new annual expenses plus continuation of $133.7 million in annual expenses currently funded by the Township

• Approximately $19.9 million in capital costs related to Public Works and Law Enforcement in the first five years

- Funded through existing incorporation and capital reserve funds

- Police/Municipal Court facility anticipated to be partially funded through

incorporation reserve funds

LAW ENFORCEMENT:

Current Provider: Montgomery County, Harris County

Proposed Provider: City of The Woodlands with contracted support from Montgomery and Harris Counties

Incorporation impact(s):

• The city will employ its own Marshal/Chief of Police and its own police force; will operate its own Municipal Court

• Specialized support services (e.g. 911 dispatch, crime lab, etc.) contracted with Counties

• Aligns public safety identity with The Woodlands rather than Counties

• Requires additional annual operating and capital costs

Costs:

• Approximately $9.7 million in new annual operating costs for personnel, materials, supplies, and overhead

- Offset by new revenues, including court fines/fees and projected growth in existing revenue sources

• Approximately $9.7 million in new startup capital and major equipment costs in the first five years

- Funded through existing incorporation and capital reserve funds

- Police/Municipal Court facility anticipated to be partially funded through

incorporation reserve funds

TRANSPORTATION INFRASTRUCTURE AND PUBLIC WORKDS/MUDS

Incorporation Impact(s):

• Increased responsibility for infrastructure management and maintenance

- ~500 miles of paved roadway (mostly concrete)

- Road shoulders

- Bridge deck maintenance

• Public Works authority consolidated under new City

• Option to consolidate Municipal Utility District services under the City in the future

Costs:

• Approximately $1.5 million annual maintenance costs related to pavement, road shoulder, and bridge deck maintenance

• Approximately $4.8 million in new annual operating costs for personnel, materials, supplies, and overhead

- Offset by new revenues and projected growth and existing revenue sources

• Approximately $10.2 million in startup capital and major equipment costs in the first five years

- Funded through existing incorporation reserve funds

Visit www.thewoodlandsincorporationstudy.com for further information.

A video of the meeting can be viewed here.

The night included a general presentation, which was provided by Township Chairman, Gordy Bunch, as well as representatives from the Township’s consulting team, The Novak Consulting Group, newly acquired by Raftelis.

Executive Vice President, Julia D. Novak, and Senior Manager Jonathan Ingram, discussed in detail Incorporation Study Goals and Approach, as well as Incorporation Study Findings; Revenue Under Incorporation, Law Enforcement, Infrastructure/Public Works, General Government, and Tax Rate Impact.

Following the presentation, residents had the opportunity to split into four “breakout areas” that covered Governance, Infrastructure, Law Enforcement, and Finance. At each station, residents were asked to write their questions down on an index card. The cards were then read aloud and addressed. Chairman Bunch stated that these questions/answers will be placed under a separate tab on the Township’s Incorporation Study website. The questions they were unable to get to will be included as well.

Novak provided a summary of resident questions, which included:

• Governance: Local control - Who would have control under a City or a Township? Who would control infrastructure and decisions about roadways? What would happen if The Woodlands Mall needed to be redeveloped?

• Infrastructure: The question of control was raised again - Who would control the right-of-ways? Who would be in charge of maintenance?

• Law Enforcement: There seemed to be a lot of questions about Creekside Park, and ensuring the current level of service and care.

• Finance: Questions were geared toward the incorporation reserve funds and whether or not it could be used to lower taxes, as well as franchise fees - How will they be passed on to consumers?

Current FAQs regarding Incorporation, provided by the Township.

Follow this link to add a question of your own.

| An overview provided by The Woodlands Township |

GOVERNANCE

Current provider: The Woodlands Township

• The Woodlands Township is a Special Purpose District authorized by the State to enhance basic services provided by other agencies (e.g. counties)

Proposed Provider: City of The Woodlands

• A City of The Woodlands would be incorporated first as a General Law City, with the option to become a Home Rule City at a later date

- General Law Cities provide services explicitly authorized by the State

- Home Rule Cities derive authority from voter-approval charters and may act

unless restricted by the State

Incorporation Impact(s):

• Preserves identity of The Woodlands

• Expands local control over ordinances, taxes, building code, public safety, court, regional partnerships, and emergency response

• Increased responsibility for infrastructure and services

TOTAL COST OF SERVICE AND REVENUE IMPACT

Incorporation Impact(s):

• City eligible for additional revenue sources (franchise fees, alcohol and beverage tax, grants)

• City's ability to spend hotel occupancy tax is more constrained than Township

• Recent revenue growth has remained strong

• Existing reserves may be used to offset future capital costs

• Incorporation initiatives approved by the Board can be implemented with no impact on maximum tax rate, based on projected revenue growth

• Assumes implementation of property tax ceiling for residents aged 65+/disabled

Costs:

• Approximately $16.8 million in new annual expenses plus continuation of $133.7 million in annual expenses currently funded by the Township

• Approximately $19.9 million in capital costs related to Public Works and Law Enforcement in the first five years

- Funded through existing incorporation and capital reserve funds

- Police/Municipal Court facility anticipated to be partially funded through

incorporation reserve funds

LAW ENFORCEMENT:

Current Provider: Montgomery County, Harris County

Proposed Provider: City of The Woodlands with contracted support from Montgomery and Harris Counties

Incorporation impact(s):

• The city will employ its own Marshal/Chief of Police and its own police force; will operate its own Municipal Court

• Specialized support services (e.g. 911 dispatch, crime lab, etc.) contracted with Counties

• Aligns public safety identity with The Woodlands rather than Counties

• Requires additional annual operating and capital costs

Costs:

• Approximately $9.7 million in new annual operating costs for personnel, materials, supplies, and overhead

- Offset by new revenues, including court fines/fees and projected growth in existing revenue sources

• Approximately $9.7 million in new startup capital and major equipment costs in the first five years

- Funded through existing incorporation and capital reserve funds

- Police/Municipal Court facility anticipated to be partially funded through

incorporation reserve funds

TRANSPORTATION INFRASTRUCTURE AND PUBLIC WORKDS/MUDS

Incorporation Impact(s):

• Increased responsibility for infrastructure management and maintenance

- ~500 miles of paved roadway (mostly concrete)

- Road shoulders

- Bridge deck maintenance

• Public Works authority consolidated under new City

• Option to consolidate Municipal Utility District services under the City in the future

Costs:

• Approximately $1.5 million annual maintenance costs related to pavement, road shoulder, and bridge deck maintenance

• Approximately $4.8 million in new annual operating costs for personnel, materials, supplies, and overhead

- Offset by new revenues and projected growth and existing revenue sources

• Approximately $10.2 million in startup capital and major equipment costs in the first five years

- Funded through existing incorporation reserve funds

Visit www.thewoodlandsincorporationstudy.com for further information.

Comments •