********************************************************************************************************

IT’S ALMOST TIME TO RE-SHOP YOUR MEDICARE ADVANTAGE AND DRUG PLAN FOR 2024

By D. Kenton Henry, editor, broker, agent

6 September 2023

With the Labor Day holiday behind us, summer is virtually over. And, the coming of fall brings Medicare’s Annual Election Period (AEP). For those new to Medicare, and as a reminder to those recipients who are not, this period runs from each fall. Beginning October 1, we can preview the new Medicare Advantage and Part D drug plans to determine which, if any, is superior to our current plan, and from October 15 to December 7, enroll in it. Our new plan selection will go into effect on January 1. Of course, if your current plan remains your best option, you need not do a thing, and it will roll right over into the new year. Simply continue to pay your premium.

But how will you know if a superior Medicare Advantage or Part D Drug plan exists for you in the coming year? First, your current drug plan owes you an Annual Notice Of Change (AOC). It must come in your U.S. mail by September 30. If they do not send it, they violate Medicare regulations. So be sure to watch your mail closely. I know we are all being inundated with advertisements this time of year in a frenzied attempt to garner our business, but sort through it long enough to find your AOC!

Then, please review it carefully. While it may remain virtually the same in the coming year, something inevitably changes. Be it the premium, the copays, the out-of-pocket maximum, the doctors and hospitals, or the drugs. Once you are aware of any changes, you must compare your plan to all the new plans in the new year. Or – you may simply call me. I have been in the medical insurance industry since 1986, specializing in Medicare-related insurance and Under Age 65 Individual and Family health insurance. As I and my clientele have grown older, I have focused even more on assisting Medicare recipients.

Researching and identifying a plan that is in my client’s best interest and making my recommendation is an annual service I provide them. While some can do it independently, my familiarity with all the options and the mechanisms for exploring and enrolling in them is so great that many find it easier to sit back and let me do the research for them. Then, if they agree with my recommendation, I am happy to enroll them, making the process go as quickly and smoothly as possible. There is no obligation to take my recommendation, nor is there any fee charged by me whether one does or doesn’t. Should you enroll through me, you will be charged no more for the product than if you walked through the front door and acquired it directly from the insurance company offering it. So I believe you get the benefit of my 37 years of experience in the market at no cost to you. While Medicare requires that I inform you, no one agent can represent every company and plan in the market, I do represent most. I have diligently researched which plans I believe will be most competitive for most people’s purposes and have studied and certified (tested) to be able to insure you with them. And more importantly, I have reviewed all of them relative to your needs before making my recommendation. On the rare occasion I am not appointed (contracted) with a company in your best interest, I will recommend them just the same and encourage you to enroll with them and advise you how to go about that. I do so in the hopes that it will begin a relationship with you and that – next year – I may be appointed with the company with which you wish to enroll.

So, while the leaves don’t fall much around here in October, they do turn brown. And Joe Willy Namath and J.J. Walker will soon be annoying you with their incessant and infernal commercials. Let these things remind you to call me for the answers to your Medicare-related questions and any guidance you would like. Remember, there is no cost to you for such, and, at the very least, you’ll know you are doing everything right and make another friend in the process.

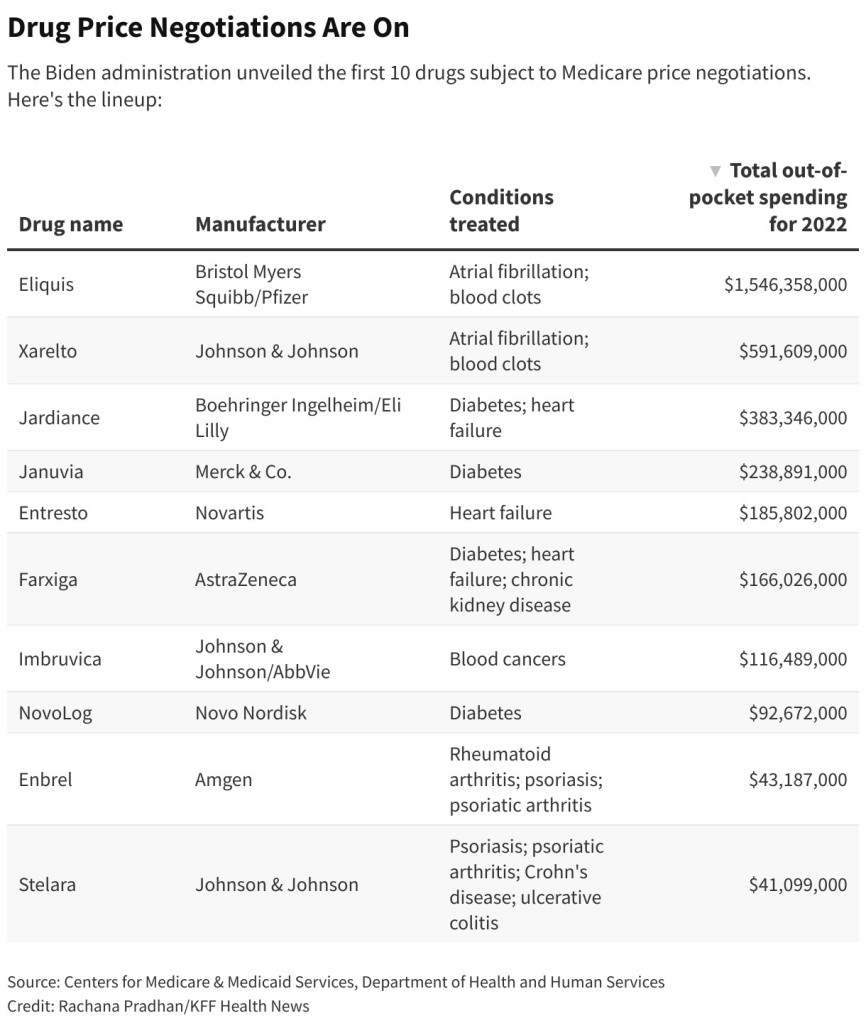

Oh – again! Please read my feature article, which appears directly below this. The current administration is attempting to lower drug costs for Medicare recipients by allowing Medicare to negotiate lower drug prices, for the first time, with pharmaceutical companies. The article identifies 10 of the most expensive drugs they target for lower costs. If you, like me, have been exposed to the never-ending drug commercials accompanying your television programs, you probably can already guess what some of them are. Obviously, advertising works, and the companies must pay for it somehow!

I look forward to hearing from you!

D. Kenton Henry

Office: 281-367-6565 Text me 24/7 @ 713-907-7984 Email: Allplanhealthinsurance.com@gmail.com Https://TheWoodlandsTXHealthInsurance.com Https://HealthandMedicareInsurance.com

***************************************************************************************************FEATURE ARTICLE:

BLOOMBERG LAW

Sept. 5, 2023, 4:05 AM

Drugs Up for Medicare Price Cuts Fuel Drugmakers’ Legal Strategy

Ian Lopez: Senior Reporter

Nyah Phengsitthy: Reporter

Drugmakers are poised to change their lawsuits and bring new ones against the Biden administration now that the list of the first 10 drugs subject to Medicare price negotiations is out.

Bristol-Myers Squibb Co., Johnson & Johnson, and other companies with drugs up for negotiation are likely to amend their lawsuits against the price talks under the Inflation Reduction Act to better their chances at taking down the program, legal analysts say.

Amending complaints could bolster the plaintiffs’ chances at overcoming government arguments that they lack standing to sue and allow them to later move for summary judgment or request a preliminary injunction.

Companies like Amgen Inc. and Novo Nordisk that have drugs on the list but haven’t sued yet may do so, or join suits already filed, attorneys say, contributing to a pharmaceutical industry legal strategy geared toward getting the US Supreme Court to intervene.

“Now that the list is announced, we’ll definitely see movement in the lawsuits, because beforehand it was a little more of a theoretical harm,” said Carmel Shachar, a professor at Harvard Law School. “I think we’ll see a big flurry of action when the prices are announced as well, with attempts to hold it up with injunctions and summary judgment.”

Drugmakers and industry groups that sued before the release of Medicare’s list issued statements afterward that they remain steadfast in their position that the price negotiation program is unconstitutional. Eight lawsuits were filed before the list announcement. Another company with a drug on the list, Novartis AG, sued after.

“The IRA’s price control provisions will constrain medical innovation, limit patient access and choice, and negatively impact overall quality of care,” J&J said. “The IRA’s policies put an artificial deadline on innovation, threatening intellectual property protections and shortening the timeframe to deepen our understanding of patients’ unmet medical needs. At the same time, seniors could face bureaucratic barriers to access and potentially higher out of pocket costs even with the IRA’s out-of-pocket cost limits for Part D drugs.”

Attorneys note that some of the lawsuits may be scaled back with the list out, while others are expanded to encompass new claims. Some judges may try and consolidate the litigation, the attorneys say.

They also note that more drugmakers may push courts for a preliminary injunction against the program to buy time while the litigation inches its way to the highest court.

“They’re not going to give this up quietly,” said Yaniv Heled, a professor at Georgia State University College of Law. “You can expect to see lawsuits, and then appeals, and then more lawsuits and then more appeals.”

‘Fight to the Bitter End’

The 10 drugs selected for pricing negotiations are Bristol-Myers and Pfizer Inc.‘s Eliquis, J&J’s Xarelto, Boehringer Ingelheim and Eli Lilly & Co.‘s Jardiance, Merck & Co. Inc.‘s Januvia, AstraZeneca PLC’s Farxiga, Novartis’ Entresto, Amgen’s Enbrel, AbbVie Inc. and J&J’s Imbruvica, J&J’s Stelara, and Novo Nordisk’s Fiasp and NovoLog insulin products.

Pfizer said it wouldn’t be leading negotiations over Eliquis’ list price and that the task would fall to Bristol-Myers. Eli Lilly similarly said the company “will not have any role in whatever price is set” by Medicare for Jardiance.

Novo Nordisk said it “will explore all options that allow us to drive change for people that need it and strive to continue to bring innovative medicines to the market while helping increase access for those that need them,” though it took issue with the government’s approach. Likewise, AstraZeneca said it would “evaluate our next steps over the coming weeks.”

Merck filed the first lawsuit to block the negotiations in June, followed by suits by other drugmakers and their allies, arguing the program was unconstitutional or violated procedural requirements for implementation.

They’re awaiting a decision from Judge Michael J. Newman of the US District Court for the Southern District of Ohio on the U.S. Chamber of Commerce’s request for a preliminary injunction—an ask that could halt the program before negotiations even begin.

The Chamber asked the court to rule before the Oct. 1 deadline when drugmakers must decide if they will enter negotiations. The group said the Biden administration didn’t do its “homework” to understand price control schemes and is rushing for implementation.

“They had a year to research these basic questions,” Neil Bradley, the Chamber’s executive vice president and chief policy officer, said in a press call.

Drugmakers who’ve already filed lawsuits will “fight to the bitter end,” Heled said.

“I can’t imagine that the litigations are going to end before these prices are supposed to take hold or go into force,” Heled said.

Drug manufacturers on the list will also “definitely” want to amend their complaints, said Laura Dolbow, a fellow at the University of Pennsylvania Law School who specializes in administrative law.

Companies may also amend their complaints to include additional causes of actions, said Andrew Twinamatsiko, associate director of the Health Policy and the Law Initiative at Georgetown University’s O’Neill Institute. For example, plaintiffs arguing the program violates the First, Fifth, and Eighth Amendments of the Constitution may consider raising Administrative Procedure Act claims like those in recent lawsuits from AstraZeneca and Boehringer Ingelheim.

Drugmakers “could find a creative way of going around” the drug pricing law’s preclusion of judicial review of prices, he said.

More constitutional claims could emerge, and the courts could have a “remarkably large number of potential avenues to consider,” said Robin Feldman, a law professor at the University of California, San Francisco.

“What are they not claiming?” Feldman said. And “lawsuits already filed have named more constitutional provisions than most people knew existed.”

‘No Standing’

Astellas Pharma Inc., which filed a suit July 14, ended up with none of its products on the list. Legal experts expect Astellas’s case to be dismissed.

The drugmaker said in a statement that no decisions have been made regarding its lawsuit, but it remains confident in its stance that the program “would result in lower costs for the government, but not necessarily reduce out-of-pocket costs for patients.”

The case brought by trade group Pharmaceutical Research and Manufacturers of America also faces possible dismissal.

The Biden administration filed a motion to dismiss the PhRMA suit in the US District Court for the Western District of Texas a day before the list came out, specifically asking that the National Infusion Center Association be dismissed because it lacks standing and failed to allege that the federal program will cause any of its members an injury.

The actions drugmakers with products on the list take now could affect what other manufacturers will do in the future, said Nicholas Bagley, a law professor at the University of Michigan. The experiences of the drugmakers in the first round of negotiations could set the precedent for price talks in later rounds.

“If you’re a manufacturer who doesn’t have a drug listed, you’re likely to sit back and watch these other litigants,” Bagley said.

To contact the reporters on this story: Ian Lopez in Washington at ilopez@bloomberglaw.com; Nyah Phengsitthy in Washington at nphengsitthy@bloombergindustry.com

To contact the editor responsible for this story: Karl Hardy at khardy@bloomberglaw.com