Under Age 65 2024 Individual And Family Health Insurance Enrollment Begins November 1

By D. Kenton Henry, editor, agent, broker

22 October 2023

Ever since the passage of the Patient Protection and Affordable Care Act (ACA), commonly referred to as “Obamacare”, in 2010, the Department of Health and Human Services has dictated when and under what circumstances an individual and family can apply for and obtain health insurance. This period is known as the Open Enrollment Period, and it is upon us. Each year, between November 1st and December 15th, U.S. citizens and their families may apply for and obtain health insurance effective January 1st of the coming calendar year. From then until January 15th, they may apply for coverage effective February 1st. Beyond that date, they are locked out of any health insurance plan they were not enrolled in when the year ended. Only special circumstances such as losing “creditable” coverage through no fault of their own, moving out of a plan’s area, birth of a child, or death of a covered family member allow them to apply for coverage beyond the Open Enrollment Period. And only if they were insured when the special circumstance occurred and no more than 60 days have passed. Creditable coverage meets all the mandates of the Affordable Care Act, such as guaranteed coverage for pre-existing health conditions, including pregnancy and mental health disorders, along with no out-of-pocket for preventative medicine. All coverage is guaranteed so long as the above requirements are met.

If affordability of health insurance is an issue, Premium Tax Credits (subsidies) are available from the Department of Health and Human Services (DHS) to people or families whose income falls below a certain threshold.

WHO IS ELIGIBLE FOR THE PREMIUM TAX CREDIT?

To receive the premium tax credit for coverage starting in 2024, a Marketplace enrollee must meet the following criteria:

· Have a household income at least equal to the Federal Poverty Level (FPL), which for the 2024 benefit year will be determined based on 2023 poverty guidelines

· Can not have access to affordable coverage through an employer (including a family member’s employer)

· Can not be eligible for coverage through Medicare, Medicaid, the Children’s Health Insurance Program (CHIP)

· Have U.S. citizenship or proof of legal residency (Lawfully present immigrants whose household income is below 100 percent FPL can also be eligible for tax subsidies through the Marketplace if they meet all other eligibility requirements)

· If married, must file taxes jointly

Income: For the purposes of the premium tax credit, household income is defined as the Modified Adjusted Gross Income (MAGI) of the taxpayer, spouse, and dependents. The MAGI calculation includes income sources such as wages, salary, foreign income, interest, dividends, and Social Security.

Your tax credit is based on the household income estimate you put on your Marketplace application.

Income between 100% and 400% FPL: If your income is in this range (in all states) you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan. The lower your income is as a percent of the FPL—the higher your subsidy.

The easiest way to determine whether and for how much you qualify is to call me. You will estimate your 2024 household's adjusted gross income and my subsidy calculator will tell us (based on the number of people in your household) how much your subsidy will be. If we give the DHS the same information you give me, my calculations are usually accurate to within $3.00 of what you will actually receive. We then apply that subsidy against the premium of the plan you wish to acquire and arrive at your net premium.

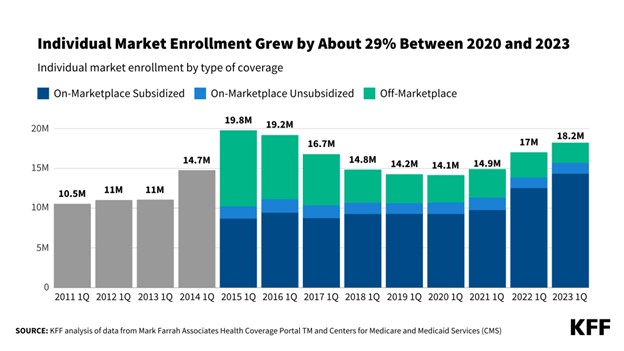

The number of people who qualify for subsidies continues to grow. For details on this, please refer to this chart and my feature article 2 below.

As to how much retail (gross) premiums are expected to grow from 2023 to 2024, estimates put the national average at 6%. (For the details on this, please refer to Feature Article 1 below.) Given the rate of core and real inflation, this should not come as a surprise. Acquisition of a subsidy will certainly offset ever-increasing premiums.

As always, the greatest challenge to the consumer and their agent/broker is affordability or obtaining the desired benefits. Instead, it is finding their doctors in the networks of a health plan. In 2024, as it was this year, there will be over 100 different plans available from six to eight different companies, depending on where one resides. Dealing with this myriad of options is where my three decades specializing in health insurance in the Houston area is invaluable. I know which hospitals are in which plan networks, and my provider search tools scan all plans without you having to go from company to company for results. Because I represent every company doing business in Texas, you can acquire information on all of them with one call to me.

Again, Open Enrollment begins November 1st, and for coverage during the entirety of 2024, it ends December 15th. Unlike going to the marketplace (Healthcare.gov) you will get me each time you call my local office with questions and for assistance and service--as opposed to an 800 number where you will get a different individual each time you call. My service is much more personalized and detailed than that of an hourly worker at the end of that toll-free number. If I don’t provide you with the level of service you deserve, I don’t have a client. And if I don’t have a client, I don’t earn a living. And it costs you no more to go through me than directly to the company whose policy you ultimately acquire.

I look forward to working with you and providing the best of service. Please call me.

D. Kenton Henry

Office: 281-367-6565

Text me 24/7 @ 713-907-7984

Email: Allplanhealthinsurance.com@gmail.com

Https://TheWoodlandsTXHealthinsurance.com Https://Allplanhealthinsurance.com Https://HealthandMedicareInsurance.com

*************************************************************************************************

FEATURE ARTICLE 1:

KFF The independent source for health policy research, polling, and news.

How much and why 2024 premiums are expected to grow in Affordable Care Act Marketplaces

Jared Ortaliza, Matt McGough, Meghan Salaga, Krutika Amin, and Cynthia Cox

Published: Aug 04, 2023

This analysis of insurers’ preliminary rate filings shows that ACA Marketplace insurers are requesting a median premium increase of 6% for 2024. Insurers cite price increases for medical care and prescription drugs as a key driver of premium growth in 2024, In addition to inflation’s impact on medical costs, insurers point to growth in the utilization of health care, which fell in 2020 but has since returned to more normal levels.

Insurers’ proposed rate changes – most of which fall between 2% and 10% – may change during the review process. Although most Marketplace enrollees receive subsidies and are not expected to face these added costs, premium increases could result in higher federal spending on subsidies.

The analysis can be found on the Peterson-KFF Health System Tracker, an information hub dedicated to monitoring and assessing the performance of the U.S. health system.

********************************************************************************************************

FEATURE ARTICLE 2:

KFF The independent source for health policy research, polling, and news.

News Release

Already at Record High, ACA Marketplace Enrollment Could Increase Further

Enhanced Marketplace subsidies have continued to drive up enrollment in the individual market, and the loss of Medicaid coverage by millions of people could contribute to this trend, according to a new KFF analysis. Meanwhile, enrollment in non-ACA-compliant plans is at a record low.

As of early 2023, an estimated 18.2 million people have individual market coverage, the highest since 2016. Individual market enrollment grew by about 29% between early 2020 and early 2023 — a result of enhanced subsidies introduced by the Inflation Reduction Act, increased outreach, and an extended enrollment period.

This enrollment growth could continue in 2023 as states resume Medicaid disenrollments amid the unwinding of the continuous enrollment provision. Some of the people losing Medicaid coverage may be eligible for subsidies on the ACA Marketplaces.

Due in part to the enhanced subsidies, about 4 in 5 individual market enrollees have subsidized coverage — the highest share since the ACA was implemented.

The number of people in non-compliant plans has fallen each year and could decrease further due to the Biden Administration’s proposed rule that would reverse the expansion of short-term plans. An estimated 1.2 million people were in non-ACA-compliant plans in mid-2022, compared to 5.7 million in mid-2015. These short-term plans often do not include certain benefits or coverage for pre-existing conditions and can impose a dollar limit on insurance coverage.

If unsubsidized premiums rise in 2024 due to higher health care prices and utilization, enhanced subsidies could shield most individual market enrollees from increases in their monthly payments.