- Categories :

- More

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Why do homes feel so expensive right now?

Many people think investors are driving up prices—but the data tells a very different story.

The Perception: Blaming Investors for High Housing Costs

Scroll through social media and you’ll see plenty of finger-pointing about why homes cost so much. And according to a national survey, a lot of people believe big investors are to blame.

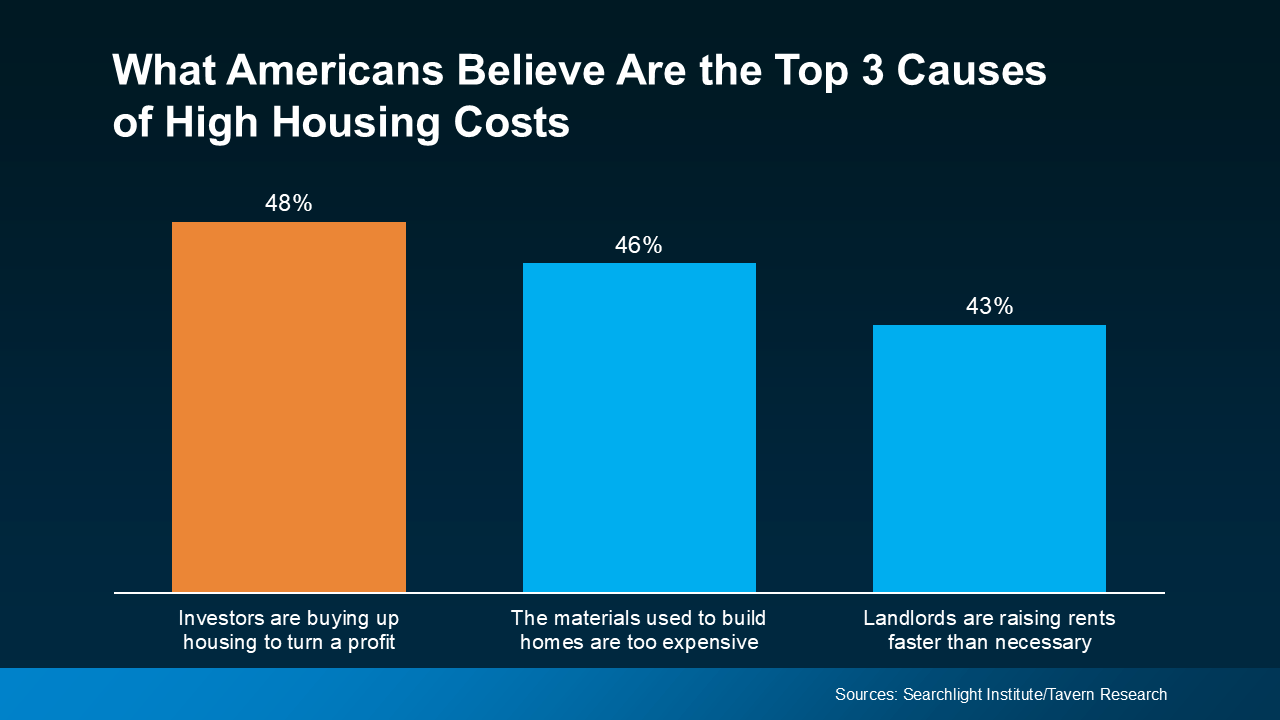

Even though data shows that’s not true, nearly half of Americans surveyed (48%) think investors are the top reason housing feels so expensive:

Source: Searchlight Institute/Tavern Research

But that theory doesn’t hold up once you look at the actual data.

The Truth About Investors

Investors do play a role in the housing market, especially in certain areas. But they’re not buying up all the homes like so many people online suggest.

According to Realtor.com, only 2.8% of all home purchases last year were made by large investors—those owning more than 50 properties. That means roughly 97% of homes were bought and sold by regular people, not corporate giants.

Danielle Hale, Chief Economist at Realtor.com, explains it clearly:

“Investors do own significant shares of the housing stock in some neighborhoods, but nationwide, the share of investor-owned housing is not a major concern.”

So if it’s not investors, what’s really behind today’s high home prices?

What’s Really Driving Home Prices Higher

The real issue has less to do with who’s buying and more to do with what’s missing—enough homes.

Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), puts it simply:

“It’s been popular among some to blame investors, but with housing, the economics of that don’t make a lot of sense. The fundamental driver of housing costs is the shortage itself—it’s driven by the fact that there’s a mismatch between the number of households and the actual size of the housing stock.”

In short, the lack of supply is the real culprit. For years, new home construction has lagged behind demand, and that shortage continues to push prices upward. Add higher material costs and limited available land, and you’ve got a perfect storm for affordability challenges.

What This Means for The Woodlands Housing Market

Here in The Woodlands, we’re seeing the same nationwide pattern: prices remain steady because demand is still strong, and inventory hasn’t yet caught up. As more homes come on the market, affordability should gradually improve—but balance will take time.

If you’ve been waiting for prices to drop significantly, the better strategy may be to focus on timing your move strategically and taking advantage of growing inventory rather than waiting for an unlikely crash.

Bottom Line

It’s easy to believe investors caused today’s housing challenges. But the truth is simpler—the market just needs more homes. As new listings increase and builders catch up, housing affordability in The Woodlands may slowly improve.

Let’s connect to talk about what’s happening locally and create a plan that makes sense for your goals.