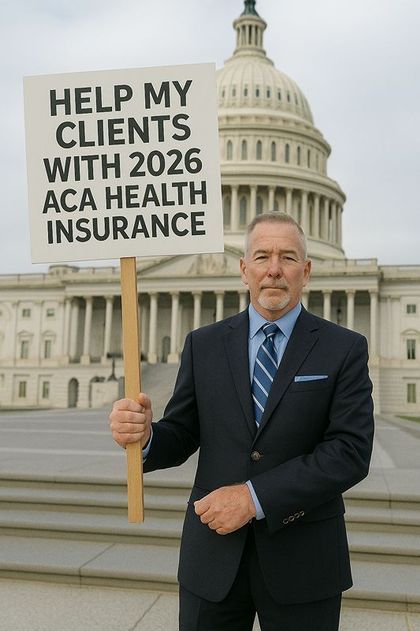

(What Consumers Need to Know for the 2026 Marketplace)

D. Kenton Henry – editor, agent, broker

As we approach the 2026 plan year, one of the biggest questions in individual and family health insurance is what will happen to Advance Premium Tax Credits (APTCs)—the subsidies that lower monthly premiums for millions of Marketplace enrollees.

Why This Is Happening

During the COVID era, Congress passed temporary legislation — most recently extended under the Inflation Reduction Act (IRA) — which made Marketplace subsidies more generous and available to more households. These enhanced subsidies are scheduled to expire at the end of 2025, unless Congress acts to extend them.

If they expire, the Marketplace will revert to pre-COVID subsidy rules, which means:

1. Lower income thresholds for subsidy eligibility

Some households who qualified for subsidies under the temporary rules will no longer qualify at all.

2. Smaller subsidies for many who remain eligible

People who received very large subsidies during 2021–2025 would see higher net premiums for 2026, even if their income has not changed.

3. The return of the “subsidy cliff”

Under pre-COVID rules, households with income even slightly above 400% of the Federal Poverty Level received no subsidy. The COVID-era rules removed that cliff. If not renewed, the cliff returns.

This is why some people are seeing early projections showing their 2026 premiums rising sharply.

Where Things Stand in Congress

Both parties publicly acknowledge that the expiration would lead to large premium increases for many families. As of today:

- There is broad interest in finding a solution, but

- No final legislation has been passed,

- No guarantee exists that the enhanced subsidies will continue, and

- Any resolution will likely be tied to larger budget negotiations.

In short: Congress is still debating it, and the outcome directly affects what consumers will pay for Marketplace coverage in 2026.

What Consumers Should Expect

Until Congress acts, the Marketplace must begin preparing 2026 rates under the assumption that the enhanced subsidies expire. This means:

- Preliminary quotes may show dramatically higher net premiums

- Some currently subsidized families may temporarily appear ineligible for assistance

- Final 2026 subsidy amounts cannot be known until legislation is passed — if it is passed

It is important to remember that this may change, depending on Congressional action in the coming months.

Practical Guidance for Individuals and Families

- Don’t panic if early projections show large increases.

- Stay informed — subsidy rules may be extended or modified.

- Review your 2026 options with a licensed, experienced broker who can calculate subsidies under both scenarios.

- Update income estimates accurately during Open Enrollment; small changes can affect substantial tax credit differences.

Bottom Line

The enhanced ACA subsidies that helped make Marketplace coverage more affordable since 2021 are set to expire after 2025, and Congress has not yet determined whether they will be renewed. Until a resolution is reached, 2026 Marketplace premiums may appear significantly higher for many Americans.

I will continue to monitor developments closely and provide updates as soon as new information becomes available.

Additionally—

It has come to my attention that my clients have been told the First Health PPO network plan is being mistakenly interpreted by them as being an Affordable Care Act (ACA) compliant PPO network. As such, they incorrectly believe any and all of their pre-existing health conditions will be covered and that all preventive exams and medicine will be covered at no out-of-pocket cost to them. This is wrong and here is the truth, as confirmed by me and ChatGPT:

1. There are no ACA-compliant PPO plans available in Texas individual/family (On- or Off-Exchange)

Texas has not had a true ACA-compliant individual market PPO option for several years.

All carriers (BCBSTX, Ambetter, United/Optum, Aetna CVS, Oscar, Cigna, Moda, etc.) offer only:

- EPOs

- HMOs

These networks limit out-of-network benefits and require referrals or tighter network management.

A PPO requires:

- National or multi-state contracted provider access

- True out-of-network benefits

- No referral requirement

No carrier has offered this in the ACA individual Texas market since around 2017–2018.

2. Aetna is not selling ACA individual/family plans in Texas for 2026 (and has already exited)

Your clients may be confused because Aetna offers:

- Medicare Advantage PPOs

- Employer-based PPOs

- First Health networks tied to group/other products

But Aetna does NOT offer ACA individual/family plans in Texas for 2026.

So if someone believes they have an “Aetna PPO” under an ACA plan, they are mistaken. It is either not an ACA plan, or they are misinterpreting the network type.

3. If their plan is marketed as “PPO-like,” it is almost certainly:

a) A short-term medical plan

These frequently use PPO networks—including Aetna’s First Health—but they are:

- NOT ACA-compliant

- Do NOT cover pre-existing conditions

- Can cap benefits

- Can deny claims based on underwriting

b) A health-sharing ministry

Often marketed as “PPO plans” because they use rented networks, but also:

- Not insurance

- Not regulated as insurance

- No claim guarantees

- No ACA protections

c) A fixed-benefit plan that uses First Health or MultiPlan PPO

Again:

- Not insurance

- No ACA protections

- No out-of-pocket maximums

- No guaranteed coverage

d) A direct primary care + medical indemnity bundle

These are sometimes misrepresented as “PPO plans,” but they are not.

4. How to confirm instantly whether the client is on ACA-compliant coverage

Ask for one of the following:

A) The name of the carrier.

If it’s not:

- BCBSTX

- Cigna

- Ambetter

- UnitedHealthcare (UHC Marketplace)

- Aetna CVS (in some states, but NOT Texas 2026)

- Moda

- Oscar (until exit)

…then it’s almost certainly not ACA-compliant.

B) A copy of the Summary of Benefits & Coverage (SBC).

All ACA plans must include an SBC — short-term plans and sharing ministries do not.

C) Their monthly bill or ID card.

If it says things like:

- First Health Network

- MultiPlan PPO

- PHCS PPO

- Aetna PPO

- United Healthcare Choice/Choice Plus PPO

…that is almost certainly a non-ACA plan.

5. Bottom line for you:

If you believe you they are on an ACA-compliant “Aetna PPO” for individual/family coverage:

You are not. No such product exists in the Texas ACA market. You are almost certainly on a short-term plan, health-sharing product, or fixed-benefit plan using a rented PPO network.

This is an excellent opportunity for ne to help you transition to true ACA coverage, where you will regain:

- Pre-existing condition protection

- Essential health benefits

- No annual/lifetime caps

And – perhaps most importantly – Out-of-pocket maximum protection

Please feel free to call me with any questions you may have or for assistance in obtaining 2026 ACA compliant health insurance. I will make the quoting and application process go as quickly and smoothly as possible whether you quailify for a subsidy or not.

The Open Enrollment Period for a January 1 effective date ends December 15th. You have until January 15th to obtain an effective date of February 1.

D. Kenton Henry

Office: 281-367-6565

Text my cell 24/7@ 713-907-7984

Email: Allplanhealthinsurance.com@gmail.com

https://TheWoodlandsTXHealthInsurance.com

https://Allplanhealthinsurance.com

https://HealthandMedicareInsuance.com