- Categories :

- More

Why We Choose Vanguard and DFA for Our Clients

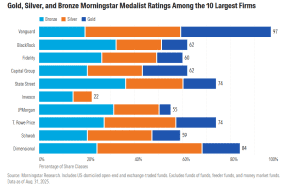

What Morningstar’s Latest Rankings Say About Vanguard—and Why It Matters to Investors

In a rapidly evolving investment landscape, the fundamentals still matter: cost, discipline, and structure. That’s why at Avion Wealth, we primarily build portfolios using Vanguard and Dimensional Fund Advisors (DFA) — two firms recently recognized in Morningstar’s 2025 Fund Family 150 Digest for their leadership and innovation.

Vanguard: Low-Cost Leader with Broad Market Access

Vanguard now manages nearly half of all passive assets in the U.S. fund industry. Morningstar credits its enduring focus on low fees and high-quality core building blocks — qualities that make it a cornerstone of our clients’ portfolios, particularly for those transitioning from business ownership to long-term wealth management.

Vanguard’s leadership isn’t just about scale. Its funds consistently earn high Morningstar Medalist Ratings, thanks in part to low fees and transparent structure — key for maintaining cost-efficiency and clarity across multigenerational portfolios.

DFA: A Growing Force in Active ETFs

Meanwhile, DFA is gaining recognition for its sophisticated yet disciplined approach to active investing. Morningstar highlights DFA’s success in converting mutual funds to ETFs and securing SEC approval to offer ETF share classes — a move expected to fuel further innovation. DFA’s factor-driven strategies complement our planning for clients who need tax-aware, evidence-based portfolio construction without excessive complexity.

What This Means for Our Clients

As fiduciaries, we believe in building client portfolios with investment partners who combine strong governance, client alignment, and long-term vision. Vanguard and DFA exemplify that. They’re not chasing fads — they’re building frameworks that help steward wealth across generations.

Whether you’re preparing for a liquidity event, building an estate plan, or transitioning from a business exit to family legacy, this structure offers stability and clarity in an often noisy investment world.

Ready to Align Your Portfolio with a Long-Term Strategy?

If you’re navigating a business exit, managing new liquidity, or planning for generational wealth, now is the time to review your investment structure. Schedule a confidential consultation to see how a disciplined, evidence-based portfolio — anchored by firms like Vanguard and DFA — can support your broader wealth transition goals.

To your success,

The Avion Wealth Team

Compliance Note

This article is for educational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Past performance is not indicative of future results. Investment decisions should be made based on individual goals, time horizons, and risk tolerance. For more details, please refer to Avion Wealth’s Form ADV Part 2 and our full disclosures.

Sources

Morningstar Research, How Vanguard Stacks Up Against Its Fund Industry Peers, September 2025.