- Sections :

- Crime & Public Safety

- Restaurants & Food

- Sports

- More

Categories

Active Vs. Passive Management. . . What's the Debate

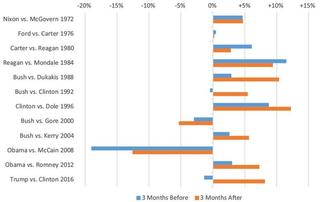

THE WOODLANDS, Texas - A debate about the best approach to asset management has raged for years, with investors, academics and investment practitioners all weighing in. The focus of this debate: active versus passive and which one yields the best returns. Following these discussions on investment styles can be dizzying. Should you chase the performers or take the slow and steady route?

When your financial advisor or money manager selects stocks or bonds for you with the goal of outperforming the market, this is active management. Historic data has shown that beating market indices is a tough challenge. Passive management, on the other hand, involves tracking an index, such as the S&P 500. Index funds are typically less exciting and a less expensive option than active management.

Trending Toward Passive Management

According to Morningstar, the flow toward passive asset management has grown consistently worldwide. Even legendary investor Warren Buffet advises index funds. But Forbes contributor and author of The Investor’s Paradox, Brian Portnoy questions this approach. While investors may believe that a passive approach automatically incorporates diversity, Portnoy argues that “buying the market” neither guarantees diversified holdings nor mitigates risk. Perhaps Nobel Prize-winning economist William F. Sharpe summarizes it best:

“Should everyone index everything? The answer is resoundingly ‘no.’ In fact, if everyone indexed, capital markets would cease to provide the relatively efficient security prices that make indexing an attractive strategy for some investors. All the research undertaken by active managers keeps prices closer to values, enabling indexed investors to, as they say “catch a free ride without paying the cost.” Thus, there is a fragile equilibrium in which some investors choose to index some or all of their money while the rest continue to search for mispriced securities. “Should you index at least some of your portfolio? This is up to you. I only suggest that you consider the option. In the long run, this boring approach can give you more time for more interesting activities such as music, art, literature, sports and so on. And it very well may leave you with more money as well.”

It Comes Down to Art, Science and Relationships

Market changes are driven by a combination of factors that are impossible to predict, from world politics to investor sentiment. We believe that an optimal strategy is one that is prudent, yet also agile and responsive. HFG Wealth Management’s investment approach has two components: core and satellite. The “core” component is structured with cost-effective and tax-efficient index funds, individual bonds and select stocks with the goal of capturing asset class returns. The “satellite” component offers further diversification and superior return potential by utilizing active management and alternative strategies. This approach relies on the insights, knowledge and experience of our team.

There’s little doubt that the debate on active versus passive investment will continue, and new approaches will surely come to the forefront. The debate endures because in investing there is no one-size-fits-all solution, and there are no guarantees. Even with the best tools, investing will remain a blend of art and science.

Year after year, the evidence shows that “passive investing” is gaining a following, but what makes this approach most compelling? We believe in pairing it with an important keystone of long-term investing: relationships. At HFG, we take the time to get to know you, to understand what you value and what you envision for your family and your future. We also foster strong relationships with industry experts, which inform our ability to monitor and adjust your investments. After all, there is no algorithm for these relationships, and no investment trend that provides the kind of connection built on trust.

The information above is intended to assist in making an informed decision, but consult your own advisor or contact HFG Wealth Management for a consultation. At HFG Wealth Management, we embrace a more holistic method of financial planning known as Financial Life Planning™. We believe this is a financially effective and personally rewarding approach to creating a practical, lasting financial plan. As financial professionals using the life planning approach, our purpose is to assist individuals and families in creating a long-term vision that is consistent with their core values. At HFG we recognize that life events and life transitions can impact your financial responsibilities and your vision of the future. We are here to provide you with tips and strategies to get you started and help you reach your financial and life goals at every stage. For more information, please visit www.hfgwm.com or call 832.585.0110

Sources:

http://blogs.cfainstitute.org/investor/2014/03/04/warren-buffetts-90-10-rule-of-thumb-for-retirement-investing/

http://www.forbes.com/sites/brianportnoy/2014/04/28/buffets-bad-advice/

http://theinvestorsparadox.com/cgi-bin/index.pl

http://www.stanford.edu/~wfsharpe/art/talks/indexed_investing.htm

http://money.cnn.com/2014/12/07/investing/stocks-active-versus-passive-investing/

When your financial advisor or money manager selects stocks or bonds for you with the goal of outperforming the market, this is active management. Historic data has shown that beating market indices is a tough challenge. Passive management, on the other hand, involves tracking an index, such as the S&P 500. Index funds are typically less exciting and a less expensive option than active management.

Trending Toward Passive Management

According to Morningstar, the flow toward passive asset management has grown consistently worldwide. Even legendary investor Warren Buffet advises index funds. But Forbes contributor and author of The Investor’s Paradox, Brian Portnoy questions this approach. While investors may believe that a passive approach automatically incorporates diversity, Portnoy argues that “buying the market” neither guarantees diversified holdings nor mitigates risk. Perhaps Nobel Prize-winning economist William F. Sharpe summarizes it best:

“Should everyone index everything? The answer is resoundingly ‘no.’ In fact, if everyone indexed, capital markets would cease to provide the relatively efficient security prices that make indexing an attractive strategy for some investors. All the research undertaken by active managers keeps prices closer to values, enabling indexed investors to, as they say “catch a free ride without paying the cost.” Thus, there is a fragile equilibrium in which some investors choose to index some or all of their money while the rest continue to search for mispriced securities. “Should you index at least some of your portfolio? This is up to you. I only suggest that you consider the option. In the long run, this boring approach can give you more time for more interesting activities such as music, art, literature, sports and so on. And it very well may leave you with more money as well.”

It Comes Down to Art, Science and Relationships

Market changes are driven by a combination of factors that are impossible to predict, from world politics to investor sentiment. We believe that an optimal strategy is one that is prudent, yet also agile and responsive. HFG Wealth Management’s investment approach has two components: core and satellite. The “core” component is structured with cost-effective and tax-efficient index funds, individual bonds and select stocks with the goal of capturing asset class returns. The “satellite” component offers further diversification and superior return potential by utilizing active management and alternative strategies. This approach relies on the insights, knowledge and experience of our team.

There’s little doubt that the debate on active versus passive investment will continue, and new approaches will surely come to the forefront. The debate endures because in investing there is no one-size-fits-all solution, and there are no guarantees. Even with the best tools, investing will remain a blend of art and science.

Year after year, the evidence shows that “passive investing” is gaining a following, but what makes this approach most compelling? We believe in pairing it with an important keystone of long-term investing: relationships. At HFG, we take the time to get to know you, to understand what you value and what you envision for your family and your future. We also foster strong relationships with industry experts, which inform our ability to monitor and adjust your investments. After all, there is no algorithm for these relationships, and no investment trend that provides the kind of connection built on trust.

The information above is intended to assist in making an informed decision, but consult your own advisor or contact HFG Wealth Management for a consultation. At HFG Wealth Management, we embrace a more holistic method of financial planning known as Financial Life Planning™. We believe this is a financially effective and personally rewarding approach to creating a practical, lasting financial plan. As financial professionals using the life planning approach, our purpose is to assist individuals and families in creating a long-term vision that is consistent with their core values. At HFG we recognize that life events and life transitions can impact your financial responsibilities and your vision of the future. We are here to provide you with tips and strategies to get you started and help you reach your financial and life goals at every stage. For more information, please visit www.hfgwm.com or call 832.585.0110

Sources:

http://blogs.cfainstitute.org/investor/2014/03/04/warren-buffetts-90-10-rule-of-thumb-for-retirement-investing/

http://www.forbes.com/sites/brianportnoy/2014/04/28/buffets-bad-advice/

http://theinvestorsparadox.com/cgi-bin/index.pl

http://www.stanford.edu/~wfsharpe/art/talks/indexed_investing.htm

http://money.cnn.com/2014/12/07/investing/stocks-active-versus-passive-investing/

Comments •