- Categories :

- More

The Art of Financial Restraint: Why the Wealthy Don’t Chase Every Opportunity

As our world increasingly shifts toward shortcuts and instant gratification, sound investment principles and concepts are often swept aside in favor of The Next Big Thing. Restraint is easily seen as a sign of weakness, further proof that “he who hesitates is lost.” Perhaps this is because the true secret to creating wealth is rather humble and decidedly unexciting: the art of saying “no.”

Unlike the flashy stereotypes, wealthy investors are prudent investors. They tend to be more selective about how and when they move money, practicing reserve and opting for slow, steady growth over trending opportunities. Not only can this approach yield more dependable results (historically speaking), but it also creates an environment where confidence, personal values, and peace of mind dictate financial decisions, rather than headlines and high emotions.

The Strength of Slow Growth

If you have ever been to the garden center of a hardware store in early spring, you’ll find yourself among rows and rows of vegetable and flower starts, standing tall and waving showy blooms long before anything has sprouted from the ground. Plants started from seed sown directly in the garden, on the other hand, are much slower to emerge. You would think that the bigger the plant, the better, but this isn’t necessarily true. Those hardware store seedlings are often pumped full of fertilizer, pushing the plants to grow faster than they can develop the hardiness necessary to withstand temperature fluctuation, while their homegrown counterparts have been slowly and steadily developing deeper roots and climate tolerance.

As Warren Buffett once noted, “The stock market is designed to transfer money from the active to the patient.” While speculation may seem more exciting and profitable for investors, its most consistent yield is an empty promise. A recent report found that 97% of day traders lose money, emphasizing what prudent investors already know: growing your wealth is a marathon, not a sprint.

Focusing on What Matters

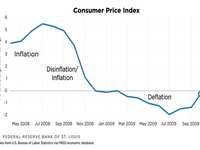

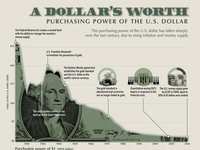

When investment decisions are guided by headlines, they often lack coherence and integrity. World news, opportunities, and the economic climate are in a constant state of fluctuation. Allowing them to dictate your investment decisions means your wealth strategy, and, in turn, your ability to reach your goals, will be subject to the same volatility. As HFG Founder and CEO Larry Harvey notes, “The hardest push has always been the button of ‘Buy Back In’. Sell [is] easy, 100%. You feel good, you’re out, you’re done. But [ ] when do I get back in? It’s gone up a little bit–no, it’s come back down–No, it’s come back up…” The same emotions that lead an investor to sell will prohibit them from having the confidence to re-enter the market, keeping them in a constant cycle of uncertainty and reactivity.

Values and goals, not fears, are the bedrock that prudent investors base their decisions upon. When you have a clear picture of what you want your wealth to mean, whether that is financial stability for your family, establishing a legacy, or a more tangible goal for the short term, that motivation serves as a filter for your financial decisions. A wise steward will ask, “Is this a decision I will feel good about 10 years from now? Does it serve the purpose that I have set for these funds?” In doing so, wealth management becomes a time-proven, proactive strategy rather than a reactive decision that only makes sense in the context of a fleeting moment.

Counting the Cost

For every “yes” that is said, a “no” is said to something else. This is the essence of opportunity cost, a concept that applies not just to wealth management but to investments of time, energy, and relationships. The wealthy understand this deeply, bearing it in mind with every decision they make. A “yes” to every opportunity without discrimination means diluting their attention from what truly matters. Shiny object syndrome can lead to hours spent managing speculative assets or constantly switching strategies, incurring a cost that is often unseen until it’s too late.

Opportunity cost is more than just a financial concept; it’s a spiritual principle, inviting us to reflect on what we value most. What are we saying “yes” to when we say “no” to a particular financial decision? Biblically, we see this illustrated clearly in the parable of the Pearl of Great Price. The merchant in the story is of singular purpose, and once he has found what he’s looking for, he sells everything to purchase it. He gives up the possibility of using his money for other purposes because he knows every “no” is a worthy tradeoff; he has gained what he set out to obtain. A wise steward doesn’t grieve lost opportunities that don’t align with their goals. They also know that wealth accumulation in and of itself won’t satisfy. It’s the freedom that their wealth provides that is worth pursuing at the cost of other endeavors–freedom to support and provide for their loved ones, live generously, and have peace of mind. In this way, financial restraint becomes a path to intentional living.

The Quiet Strength of “No”

Not all opportunities are created equal; the prudent investor lives by this truth, carefully evaluating each financial decision. Selective investment is not about scarcity of capital, but rather abundance of clarity. Developing a firm foundation comprised of your goals and values creates the opportunity to filter out distractions, no matter how enticing, creating a path to building wealth that is far more meaningful than an account balance.

HFG Wealth Management understands the value of financial restraint, helping clients develop the criteria with which to evaluate opportunities by gaining a deep understanding of what matters most to you. Our unique approach gives you the tools to live a life defined by purpose, inner peace, and personal satisfaction. If you’re ready to gain financial clarity and confidently say “no” to opportunities that don’t align with your life, start here to discover your personal litmus test with a member of our team.