- Categories :

- More

Inflation: The Silent Threat to Your Wealth (Part I)

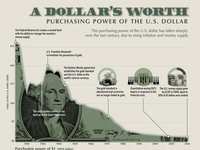

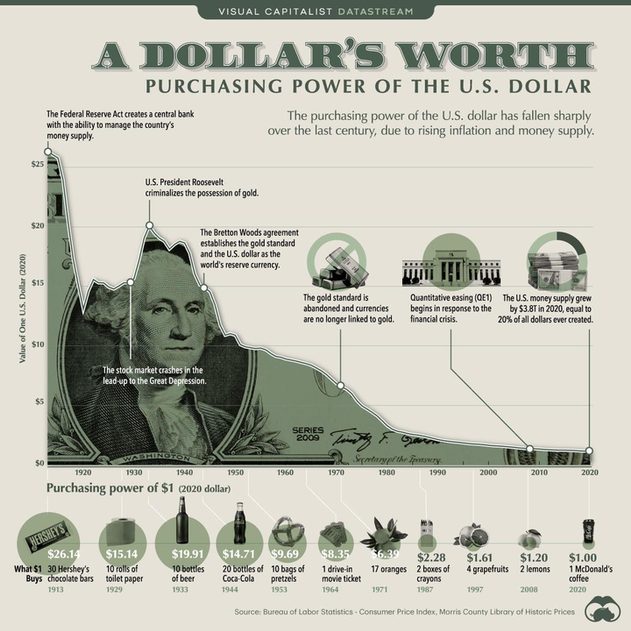

Did you know that $1 in 1925 would only be worth $17.41 today? That’s a staggering 94% loss in purchasing power, proof that inflation is a slow but relentless wealth destroyer. At Avion Wealth, we believe historical context is key to protecting your financial future. In part one of our inflation series, we explore how inflation has evolved over time and what that means for your wealth.

Inflation: A Century in Perspective

Between 1925 and 2025, the average annual inflation rate was 2.9%. But averages can be deceiving.

-

1940s (Wartime Inflation): ~5.5% annually

-

1970s (Stagflation Era): Averaged 7.1%, peaking at 13.5% in 1980

-

2021–2023 (Post-COVID Surge): Spiked to 9.1% in June 2022

The cumulative effect of these spikes is massive: $1,000 in 1925 would need to grow to over $17,000 today just to maintain the same purchasing power.

Lessons from the 1970s: Stagflation’s Painful Reality

Stagflation, a toxic mix of stagnating economic growth and rising prices, defines the 1970s. The conditions? A perfect storm:

-

Excessive Spending: Vietnam War + Great Society programs

-

Gold Standard Abandonment: Nixon officially ended the dollar’s tie to gold in 1971

-

Oil Price Shocks: OPEC oil embargoes in 1973 and 1979 led to a 400% spike in oil prices

-

Rapid Money Supply Growth: Averaged 13% annually

Perhaps Nixon’s most damaging decision was his 1971 wage and price freeze. Well-intentioned but economically flawed, it stifled the market’s natural ability to adjust. When controls were lifted, inflation surged from 4% to 12%, and the stock market plunged 45% in real terms.

Global Echoes: Germany, Venezuela & the Consequences of Printing Money

The U.S. experience pales in comparison to Germany’s post-WWI hyperinflation. In 1914, 4 German Marks equaled $1. By 1923? It took 4.2 trillion Marks.

Workers were paid twice a day. Prices rose while you ate dinner. The middle class? Wiped out.

Similar stories have played out in Venezuela and other nations that aggressively monetized debt. The lesson is crystal clear: when governments finance spending by printing money, confidence erodes, and catastrophe follows.

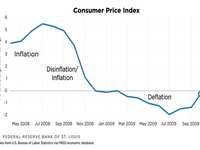

COVID-Era Inflation: A Modern Case Study

In March 2020, inflation was nearly nonexistent at 0.3%. By June 2022, it had skyrocketed to 9.1%, the highest in 40 years. It finally settled to 2.4% by May 2025, but the road was rough.

In March 2020, inflation was nearly nonexistent at 0.3%. By June 2022, it had skyrocketed to 9.1%, the highest in 40 years. It finally settled to 2.4% by May 2025, but the road was rough.

Key Drivers:

-

$5 Trillion in Fiscal Stimulus: Necessary early on, but difficult to unwind

-

Supply Chain Disruptions & Labor Shortages: Pushed costs higher

-

Energy Price Spikes

-

40% Growth in Money Supply (2020–2022)

-

Fed Rate Hikes: From 0% to 5.5% in 18 months

Why Conservative Investors Should Pay Attention

Inflation isn’t just a number. It quietly erodes the real value of your wealth, especially if your portfolio leans heavily on cash and bonds. For conservative investors, this silent destroyer can be devastating.

What’s Next in This Series?

In our next video, we’ll explore how inflation varies across the U.S., and why places like Texas may feel its effects differently than California or New York. We’ll also dive into what this means for Fed policy and your portfolio. If you have questions in the meantime, please reach out to me. We wish you nothing but success!

Best,

Paul J. Carroll, CFP®

CEO & Founder, Avion Wealth

Resources