- Categories :

- More

The $36 Trillion Question: How U.S. Debt, Fed Independence, and Inflation May Impact Your Wealth (Part III)

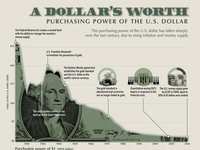

The U.S. national debt has reached a staggering $36 trillion, roughly 100% of our gross domestic product. With daily interest payments alone totaling $2.6 billion, it’s no longer a question of whether debt will impact our economy, but how, and more importantly, how it may affect you as an investor.

The Hard Truth Behind Budgeting Realities

Let’s start with the math.

-

Federal Revenue: $5.16 trillion

-

Federal Spending: $7 trillion

-

Annual Deficit: $1.9 trillion (~6% of GDP)

On paper, this may seem manageable. But when you break down where that $7 trillion is going, the flexibility to cut spending becomes illusory:

-

Mandatory Spending (Social Security & Medicare): 63%

-

Interest on Debt: 14% (and growing)

-

Defense: 13%

-

Discretionary Spending: Only 10%

Decades of attempts to trim the fat have left us with little to cut. In fact, many government agencies are now underfunded to the point of inefficiency. By 2030, debt is projected to exceed 118% of GDP.

Why Fed Independence Is Under Threat and Why It Matters

The Federal Reserve, historically an independent body, is facing increasing political pressure to cut interest rates. When this independence is undermined, financial markets take notice, and not in a good way.

Recent rhetoric from the White House has included criticism of Fed Chair Jerome Powell and even threats of termination. This has already shaken investor confidence:

-

The U.S. dollar recently hit a three-year low

-

Gold surged to $3,500/oz

-

Treasury yields spiked

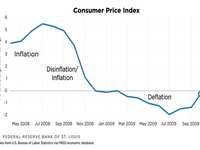

History reminds us what happens when political interference overrides economic discipline. In the 1970s, Nixon’s pressure on Fed Chair Arthur Burns gave us stagflation, a devastating mix of high inflation and low growth. It took Paul Volcker’s painfully high interest rates to restore order.

The Three Ways Out and Why Monetization Is the Most Likely

With few paths to cut spending and limited political will to raise taxes, we’re left with a third, and historically common, option: debt monetization.

What is Debt Monetization?

Debt monetization occurs when the Federal Reserve essentially prints money to buy government debt. Unlike temporary programs like quantitative easing (QE), monetization is permanent. The Fed isn’t just stabilizing the market, it’s funding the government.

Warning Signs of Impending Monetization:

-

Treasury auctions begin to fail

-

Debt-to-GDP surpasses 130%

-

Political pressure on the Fed to purchase debt

The Impact on Your Portfolio

If monetization becomes reality, it leads to inflation, or worse, stagflation. Here’s how different assets perform:

Assets That Struggle:

-

Long-term bonds: Highly vulnerable

-

Intermediate-term bonds: Moderately affected

-

Short-term bonds/cash: Safer, but still lose real value in high inflation

-

Fixed annuities and pensions: Rarely inflation-indexed

-

High P/E growth stocks: Sensitive to rising interest rates

Assets That Help:

-

Commodities: Energy, agriculture, etc.

-

Gold: Traditional inflation hedge

-

TIPS (Treasury Inflation-Protected Securities): Adjust with inflation

-

Real estate: Only when location fundamentals remain strong

-

Cryptocurrencies: A wildcard; some may hedge well, others may not

Tailoring Strategy to the Investor

At Avion Wealth, we believe inflation is a bigger risk than market volatility. Like the proverbial frog in slowly boiling water, many investors may not recognize the danger until it’s too late.

That’s why we start by assessing:

-

Your tolerance for inflation

-

Your risk appetite for alternative assets

-

Your willingness to remain short-term on debt instruments

This is not a one-size-fits-all discussion, it’s a strategic conversation we invite you to have with us.

Scenarios for 2025–2030

We see three possible futures:

-

Soft Landing (30% probability)

-

Inflation holds steady at 2–3%

-

Fed maintains independence and credibility

-

-

Persistent Inflation (50% probability)

-

4–5% inflation slowly erodes purchasing power

-

Markets remain volatile

-

-

Debt Crisis & Monetization (20% probability)

-

Confidence collapses

-

Inflation spikes and wealth destruction accelerates

-

Even if monetization is the least likely scenario, its severity demands we prepare for it.

What You Should Do Now

-

Audit your portfolio for inflation vulnerability

-

Add inflation-sensitive investments such as commodities or TIPS

-

Track Fed policy independence – a key leading indicator

Inflation is not an accident. It is a policy decision, and one that has consequences. While we can’t change federal policy, we can position your portfolio to weather the storm.

If you’re concerned about the impact of national debt, inflation, or a weakening dollar on your long-term wealth, let’s talk. At Avion Wealth, we help high-net-worth clients chart a course through uncertainty with clarity, discipline, and foresight.

Your portfolio deserves more than hope. It deserves a plan.

Best,

Paul J. Carroll, CFP®

CEO & Founder, Avion Wealth

Resources