- Categories :

- More

How Regional Inflation Affects Your Portfolio: Disinflation, Deflation, and the Fed’s Balancing Act (Part II)

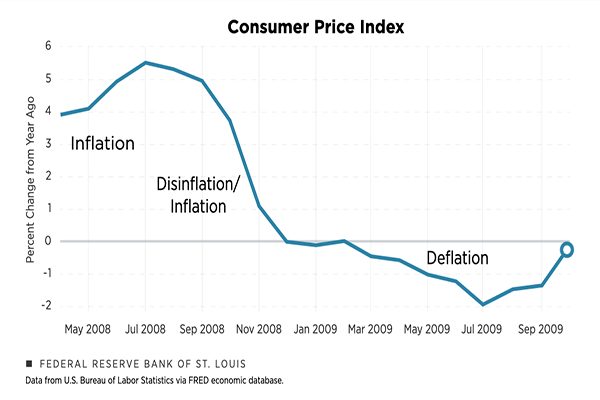

When most people hear “inflation is down,” they assume prices are falling, but that’s not quite accurate. Understanding the differences between inflation, disinflation, and deflation is essential to making informed investment decisions, especially in a market as fragmented as today’s U.S. economy.

Let’s break it down and explore what current inflation trends, both nationally and regionally, mean for you and your portfolio.

Understanding Inflation: Not All Declines Are Equal

There’s a lot of confusion about inflation and how it’s measured. At its core:

-

Inflation is when prices are rising. For example, gas prices increase from $3 to $4 per gallon.

-

Disinflation means the rate of inflation is slowing. Prices are still rising, just not as quickly. This is where we are now, down from a peak of 9.1% in June 2022 to 2.4% today.

-

Deflation occurs when prices are falling – an economic condition that can sound like good news but often signals serious trouble, including reduced consumer spending and increased debt burdens.

Right now, the U.S. economy is firmly in a disinflationary phase. Prices are still higher than they were five years ago, but the pace of those increases has dramatically slowed.

Inflation Is Not Uniform Across the U.S.

What complicates monetary policy today is that inflation isn’t the same everywhere. While the national average stands at 2.4%, regional differences are stark:

-

Texas: 1.2–1.4%

-

Florida (Tampa): ~2.6%

-

California & the Northeast: 3–4%

Why is Texas lower?

Several factors contribute:

-

No state income tax (also true for Florida)

-

Lower housing costs due to easier permitting and construction

-

Energy abundance from oil, gas, and renewables

-

An influx of new residents (around 1,000 people move to Texas daily), which helps moderate labor costs

In contrast, states like California are grappling with higher costs, driven by more rigid housing markets, tech sector layoffs, and stricter banking regulations.

The Fed’s Dilemma: One Tool, Many Economies

The Federal Reserve sets interest rates for the entire country, but it’s effectively trying to manage 50 different inflation stories. This creates a dilemma:

-

Current Fed funds rate: 4.25%–4.5% (unchanged since December 2024)

-

Market expectation: Two rate cuts anticipated this year

-

Policy stance: As Fed Chair Powell put it, “We don’t have to be in a hurry.”

But there are complications:

-

Tariffs may create delayed inflationary pressures (3–4 months to work through the supply chain)

-

Full employment (currently at 4.2%) keeps wage inflation alive

-

Commercial real estate and tech layoffs, particularly in regions like California and Austin, suffer under high rates

Just as the European Union struggles to balance Greece and Spain with Germany and France, the U.S. must reconcile diverse state economies with a single policy lever.

Winners and Losers: The K-Shaped Recovery

Some areas of the U.S. are thriving in this economic environment:

-

Texas: Driven by energy and steady population growth

-

Florida: Benefiting from tourism and services

-

The Sun Belt: Becoming a manufacturing powerhouse

This uneven growth is known as a K-shaped recovery, where certain regions or industries flourish while others struggle under lingering inflation and high borrowing costs.

Which Inflation Measure Should You Trust?

The Federal Reserve uses the Personal Consumption Expenditures (PCE) Index rather than the more commonly cited Consumer Price Index (CPI):

-

CPI (YoY): 2.4%

-

Core PCE: 2.6%—typically lower than CPI, but currently higher due to changing consumption patterns

Regionally, PCE ranges from 1.2% to over 4%, further emphasizing how different the experience of inflation can be depending on where you live.

Why This Matters to Investors and Retirees

These inflation disparities can deeply impact:

-

Portfolio performance

-

Fixed income planning

-

Real estate exposure

-

Tax policy implications

As inflation moderates, it doesn’t undo the price increases of recent years, it simply slows them. For those living on fixed incomes, planning for purchasing power protection remains critical.

Looking Ahead

In our next discussion, we’ll dive into the consequences of $36 trillion in national debt meeting a rising interest rate environment, a situation that could have profound implications for taxes, deficits, and your investments.

If you’re wondering how regional inflation or federal policy may impact your wealth strategy, we’re here to help. At Avion Wealth, we specialize in navigating these complexities for high-net-worth individuals seeking long-term financial confidence.

Reach out today! We’ll chart a course through the fog together.

Best,

Paul J. Carroll, CFP®

CEO & Founder, Avion Wealth

Resources